Download a sample plan pdf file

Advisor Pricing

The MoneyReady App offers a free trial and $60 one-month extended trial to advisors.

- Free trial: 3 runs of the TIME MACHINE.

- No credit card required.

- Use your own or your typical client scenario to try out the site.

- $60 one-month extended trial : unlimited runs of the TIME MACHINE and all pro-features included.

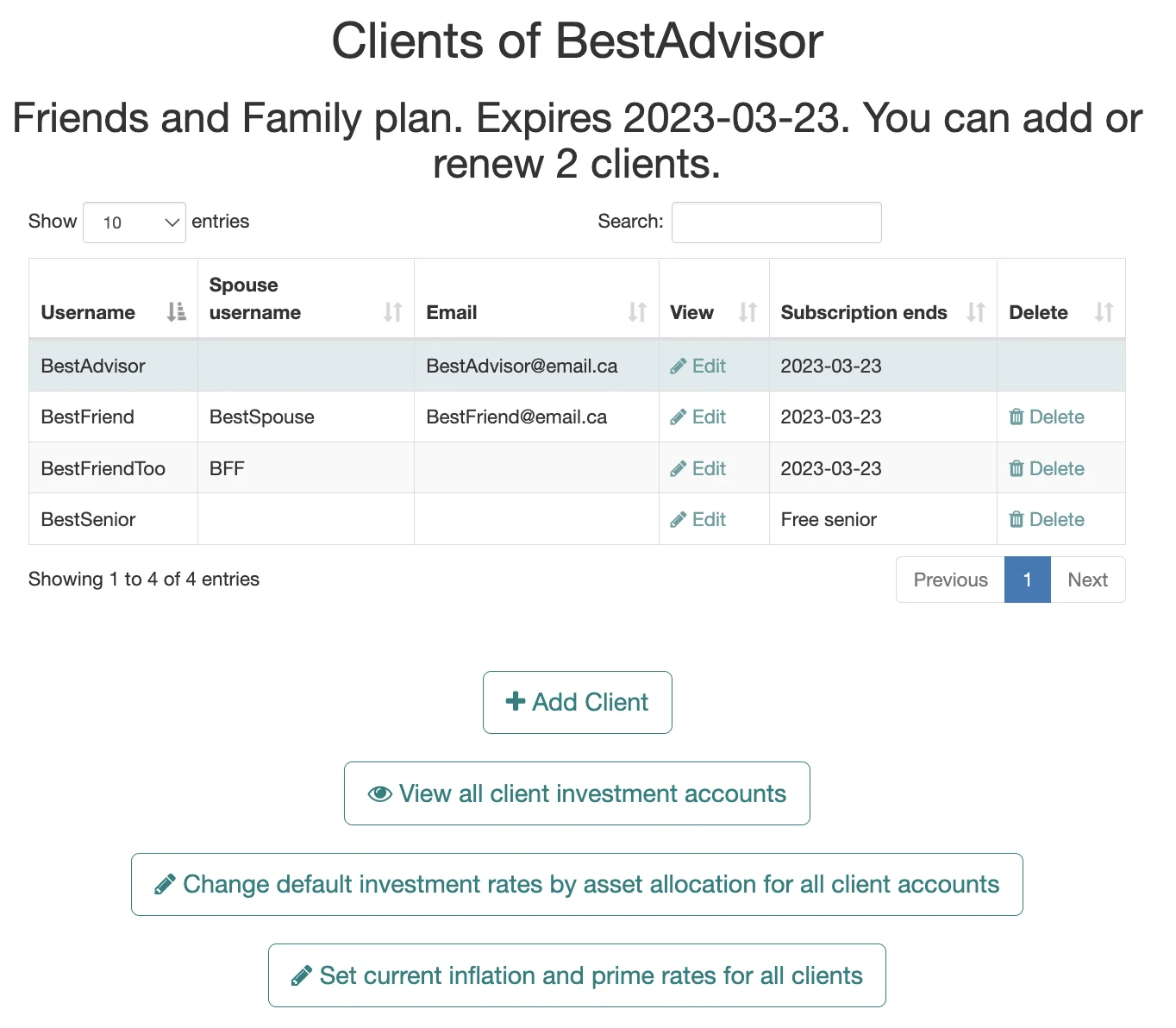

- You can add low-income senior clients for free.

Pay-as-you-go

- Client subscription expires in one year (renewable).

- Free clients after 10 purchased. Unlimited clients (Payments restart on earliest purchased client anniversary date)

- Can switch to Friends & Family or Professional plan any time.

- Always free for low-income seniors

Best for: adding clients sporadically.

Friends & Family Advisor Packs

- Additional clients can be added or renewed by purchasing additional 5-client packs or switching to either of the other plans.

- Clients expire on pack purchase anniversary date (or minimum 1 month from adding the client).

- Always free for low-income seniors

Best for: Advisors with fewer than 20 clients per year.

Professional Advisor one-year subscription

- Unlimited new clients or renewals.

- Clients expire on plan anniversary date (minimum 1 month from adding the client).

Best for: Advisors with more than 20 clients per year.

Separate site for client logins.

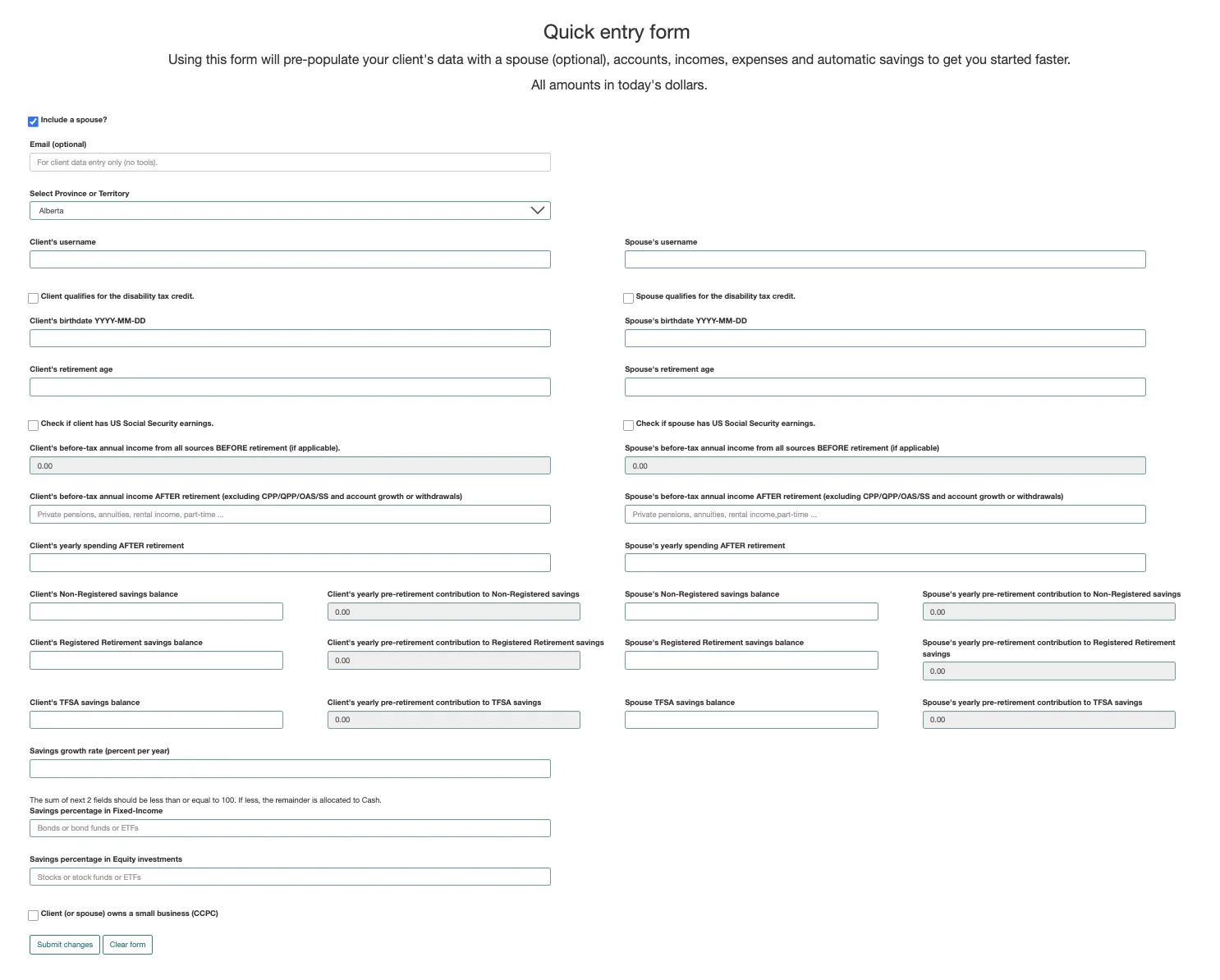

You can optionally set up your client such that they can log in to their account and enter or edit data for you or with you.

Their site is much simplified and has no calculators.

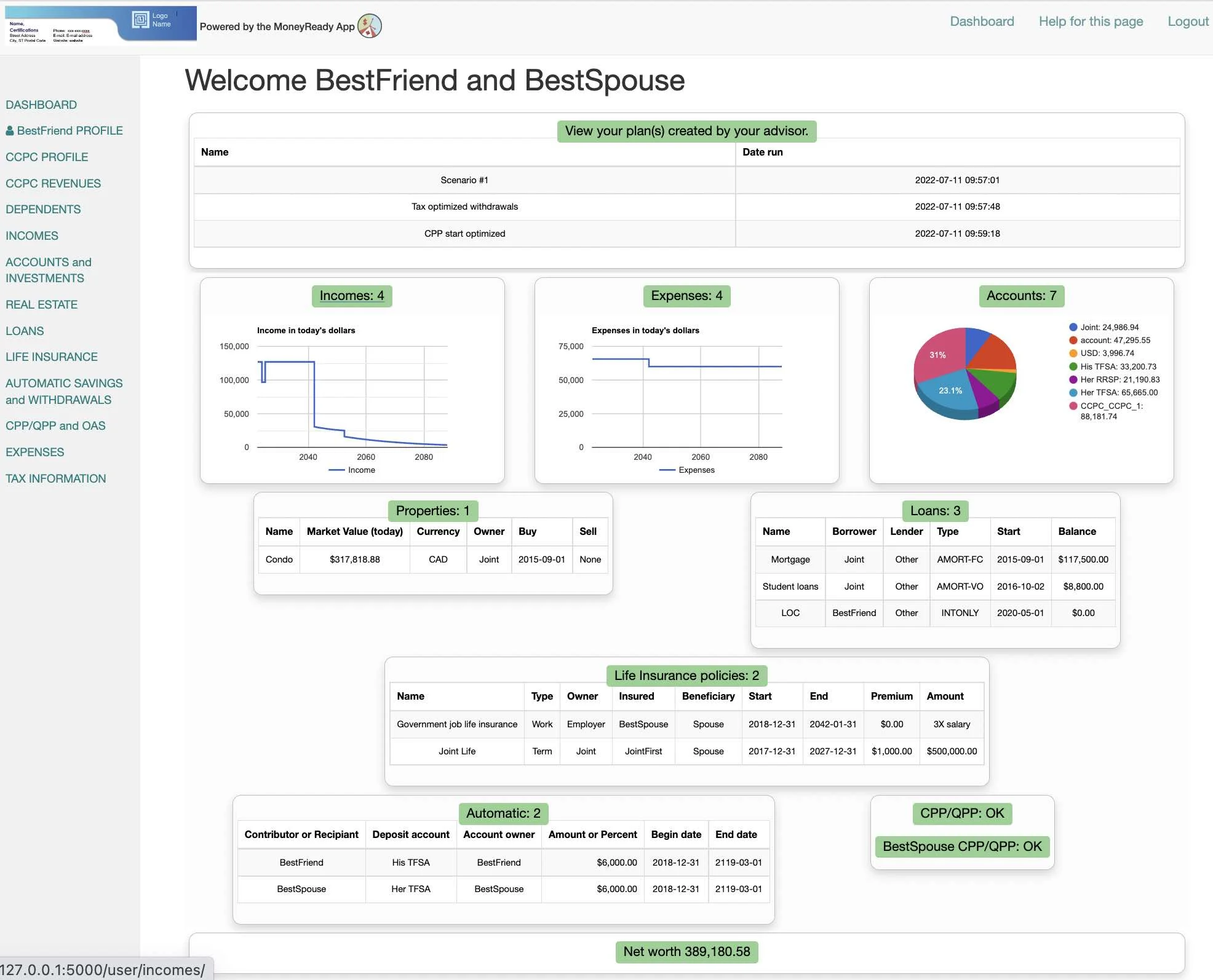

They can view and compare the plans that you allow them to see.

Your letterhead will be shown on their site and in pdf reports.

Included tools

Cash-flow Calculators and Optimizers

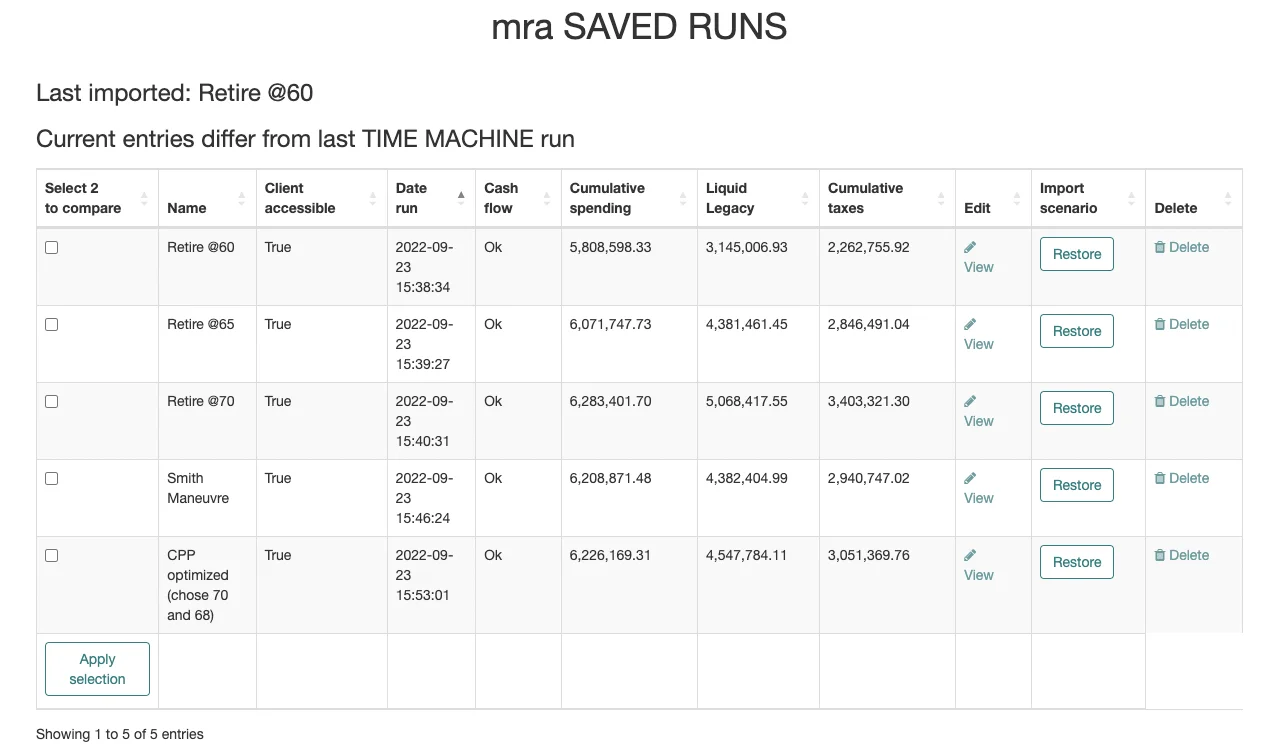

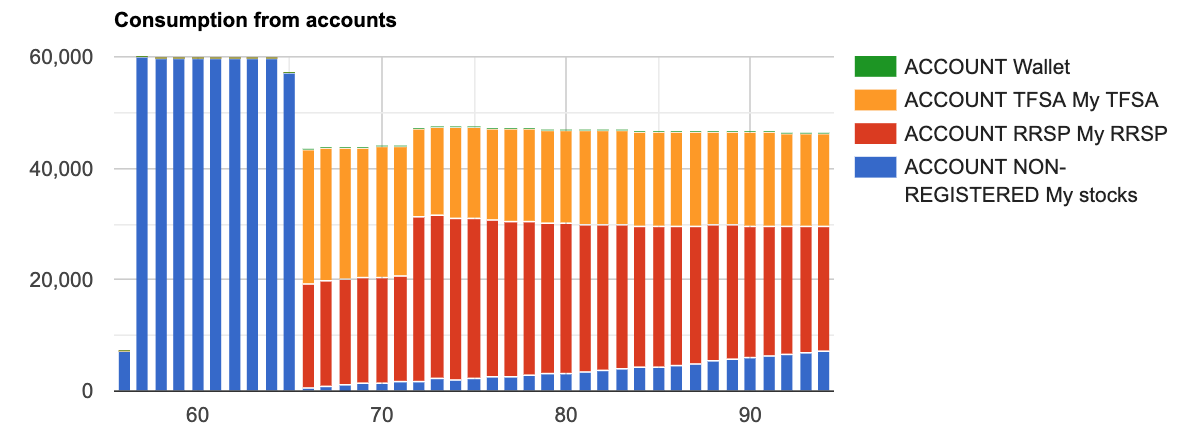

The TIME MACHINE

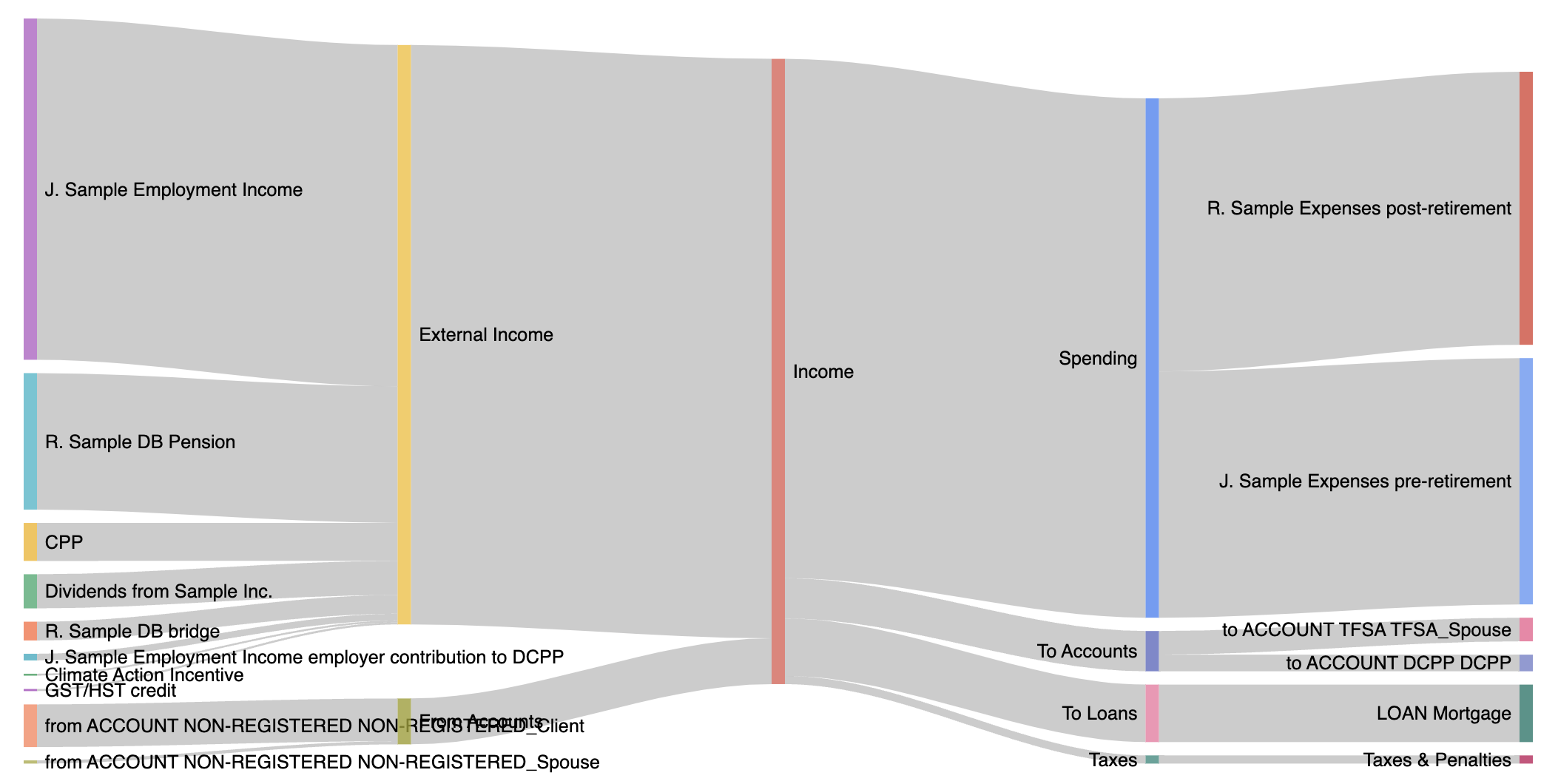

Our comprehensive and accurate calculator can handle any scenario.

CHOOSE YOUR LEGACY (subscription required)

Finds how much you can spend or give away to not run out of money and leave a legacy of your choosing.

The Withdrawal Optimizer (subscription required)

Finds the smart approach to minimize taxes in retirement and maximize your legacy.

It can also find your optimal age to start CPP.

Parameter scans(subscription required)

Runs the TIME MACHINE with modified sets of parameters you define in one go

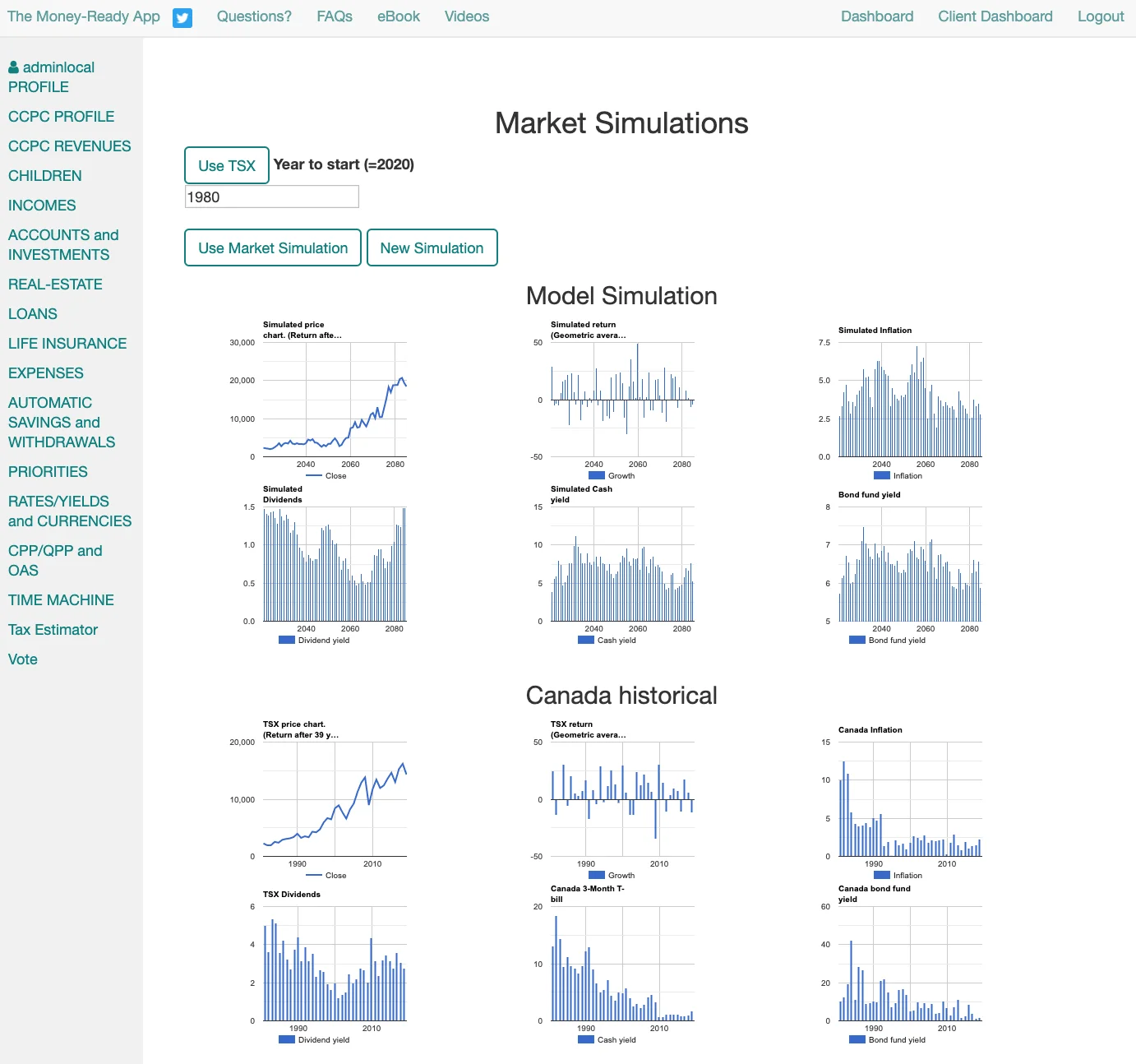

Stress testing and Monte carlo simulations(subscription required)

Simulate changing financial market conditions.

The Simple Retirement Calculator

Just one input screen with basic information. It's limited and approximate, but quick and easy. You can use it at any time for anyone. Now available without registration

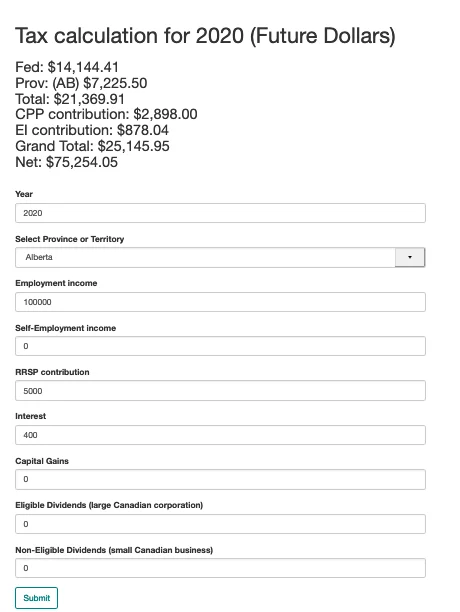

Taxes and government benefits

Taxes and most credits calculated federally and for all provinces and territories.

RDSP and RESP grants and bonds are calculated.

OAS, GIS, CPP, QPP and survivor pensions are calculated.

Corporate taxes are calculated for CCPCs.

Alternative Minimum Tax (subscription required).

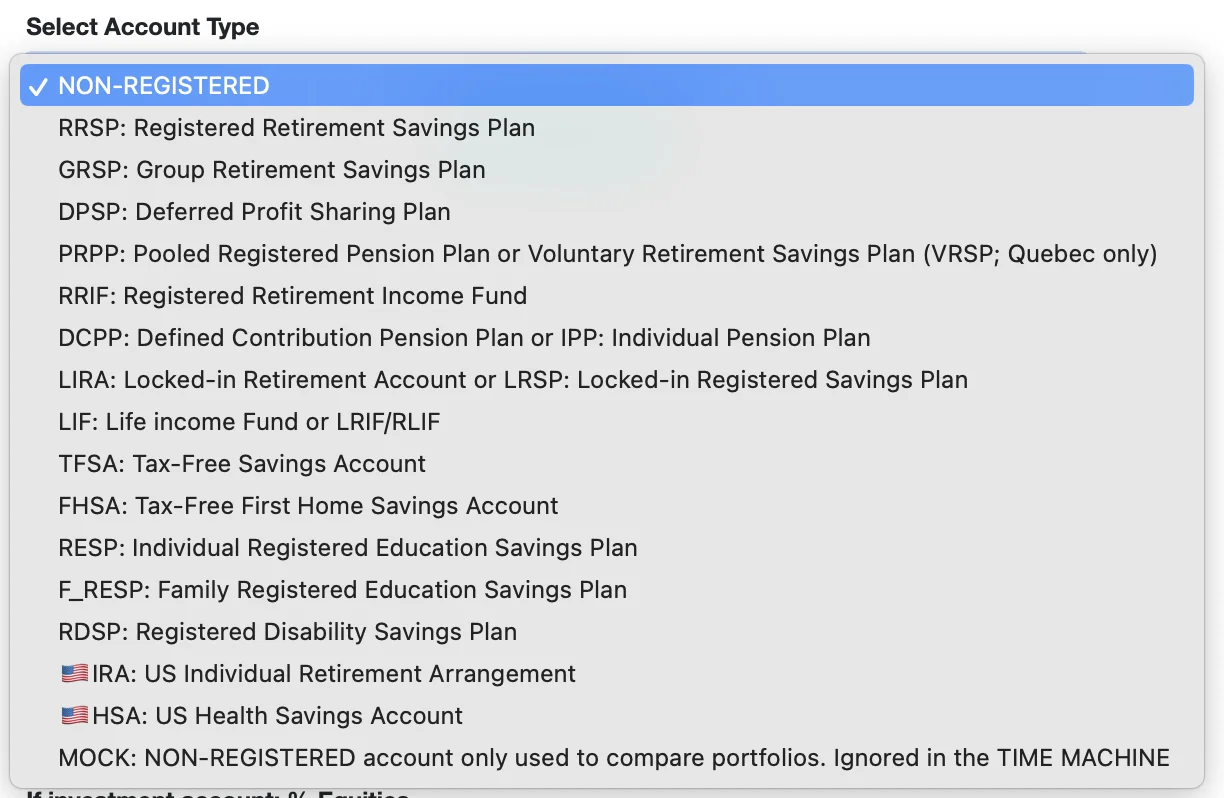

Accounts

All types of accounts available to Canadians are considered.

Can hold investments in any currency.

Advisor portfolios can easily be copied to client accounts.

Updated investment values (optional)

We update daily values and distributions for over 60,000 North American securities. Data are provided by ©Fundata Canada Inc.

This includes all Canadian and US stocks and ETFs, and all Canadian Mutual and Segregated funds.

Your distributions are updated every day in a downloadable table.

WEALTHICA

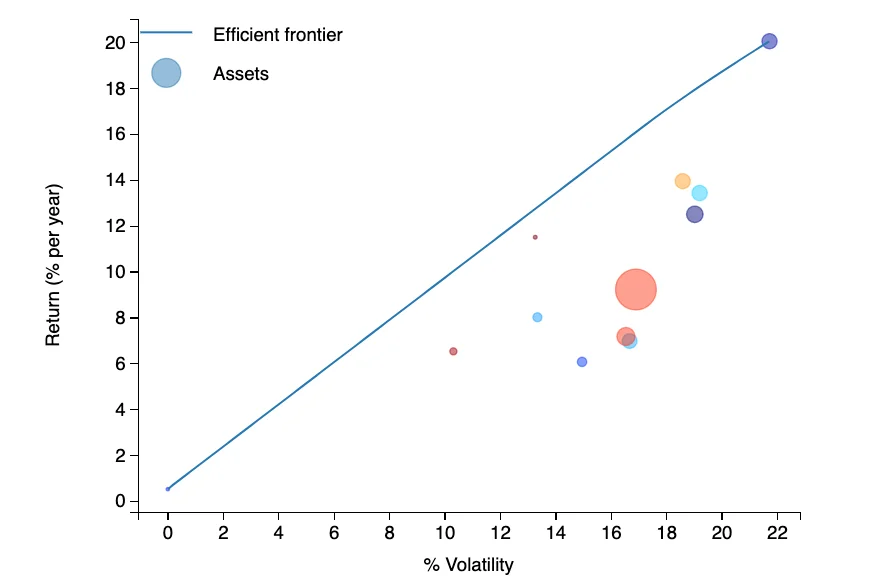

Account rebalancing and Portfolio Optimization (Subscription required)

For portfolios with fewer assets: our proprietary rebalancing tool allows for mixed-allocation funds and ETFs. It considers fees and expected returns.

For portfolios with larger number of assets: rebalance and optimize using Modern Portfolio Theory to maximize return and minimize volatility.

Rebalancing and optimization can be calculated over multiple accounts.

Pensions and Annuities

Defined benefit and defined contribution pension plans.

Employer and employee contributions considered.

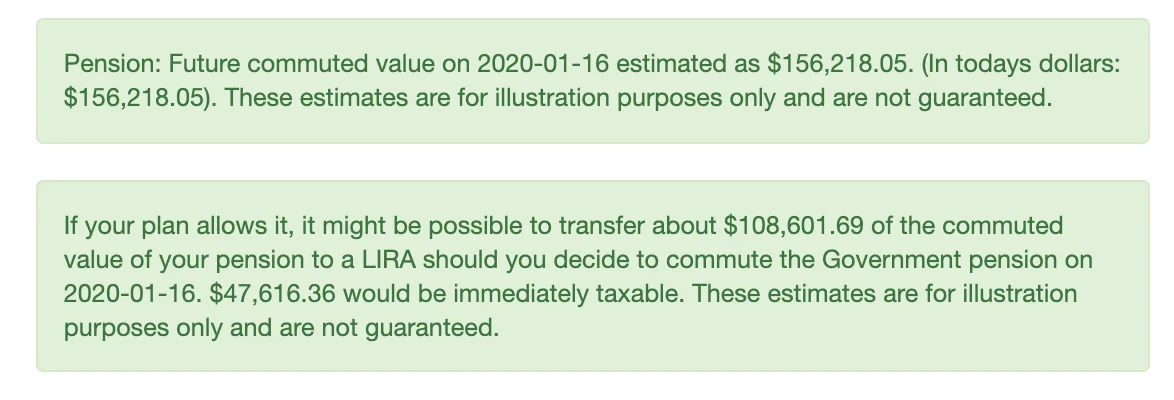

Considering the commuted value of a defined benefit pension.

Considering annuities.

Pension income splitting is automatically calculated.

OAS, GIS, CPP, QPP and survivor pensions are calculated.

HELP

A context-dependent Help screen is available on every page.

Rapid email support. English and Français

Phone/video consultation available (year subscription required). English and Français

Extensive eBook.

Our documentation in extensive because you need to know how and why things are done. We now offer a search of the entire MoneyReady documentation using AI. Just ask your question and the AI will respond with an answer and the relevant links to the documentation pages. This is experimental, and login is required to use the feature. If you want a human to answer, contact us.