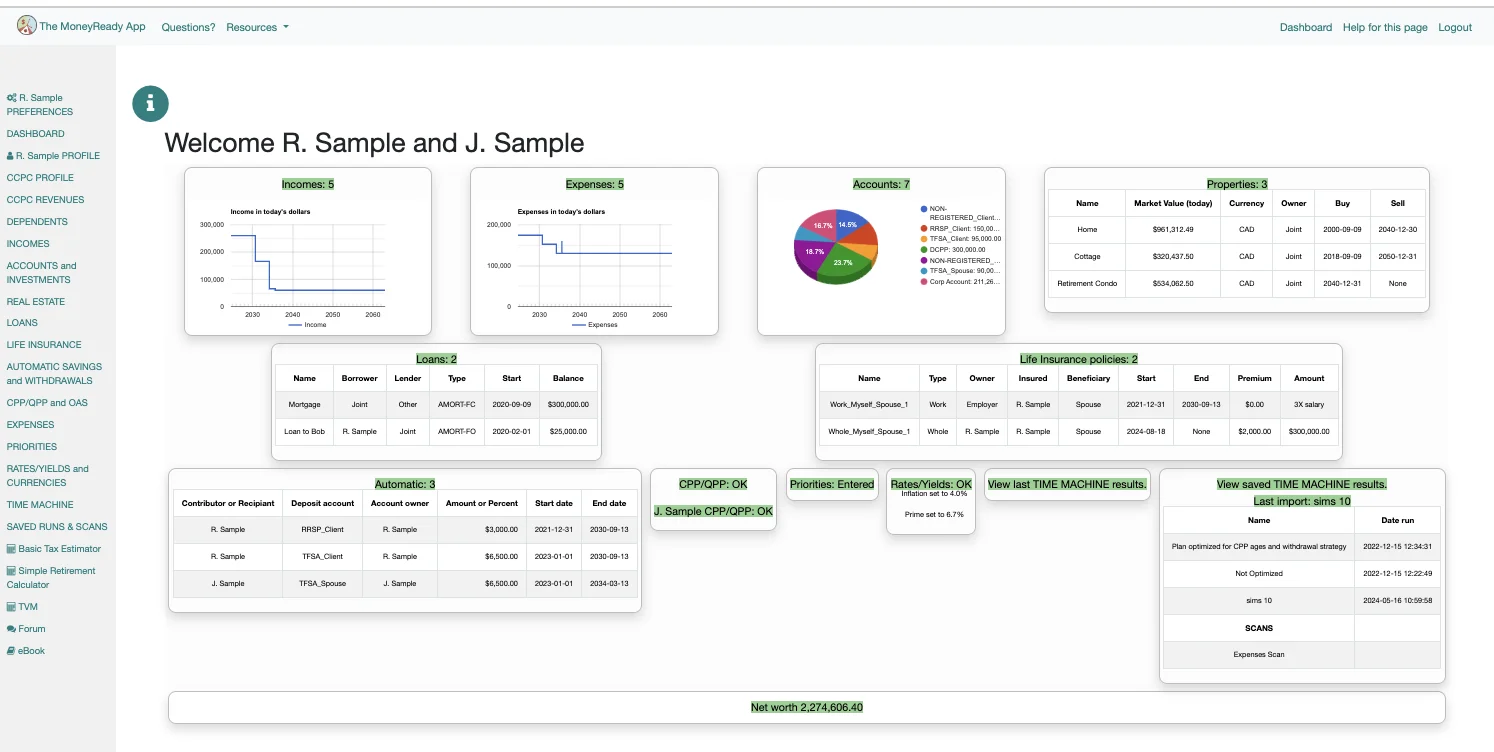

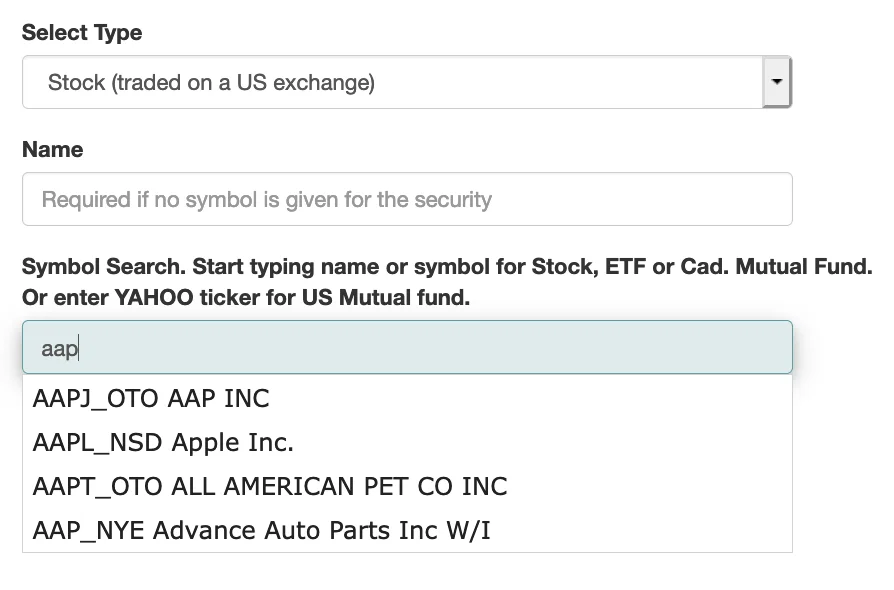

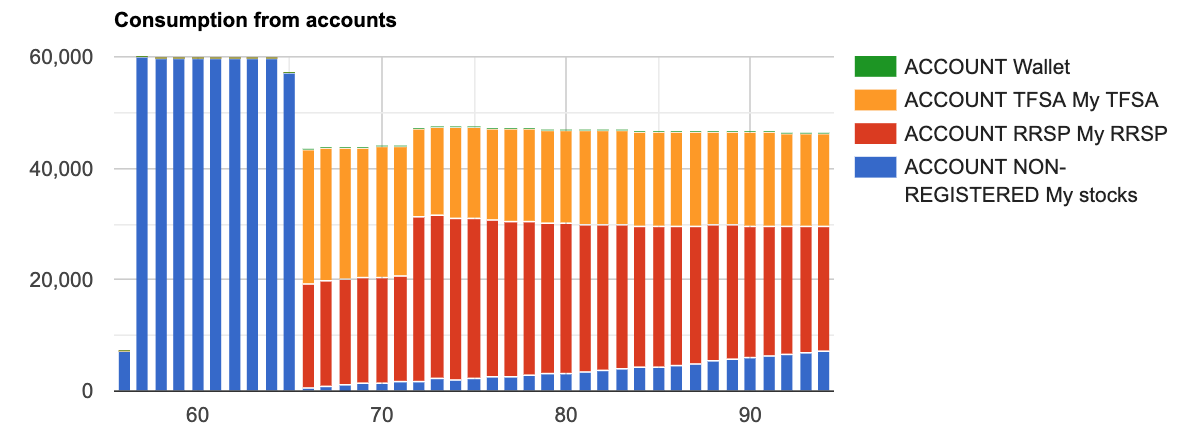

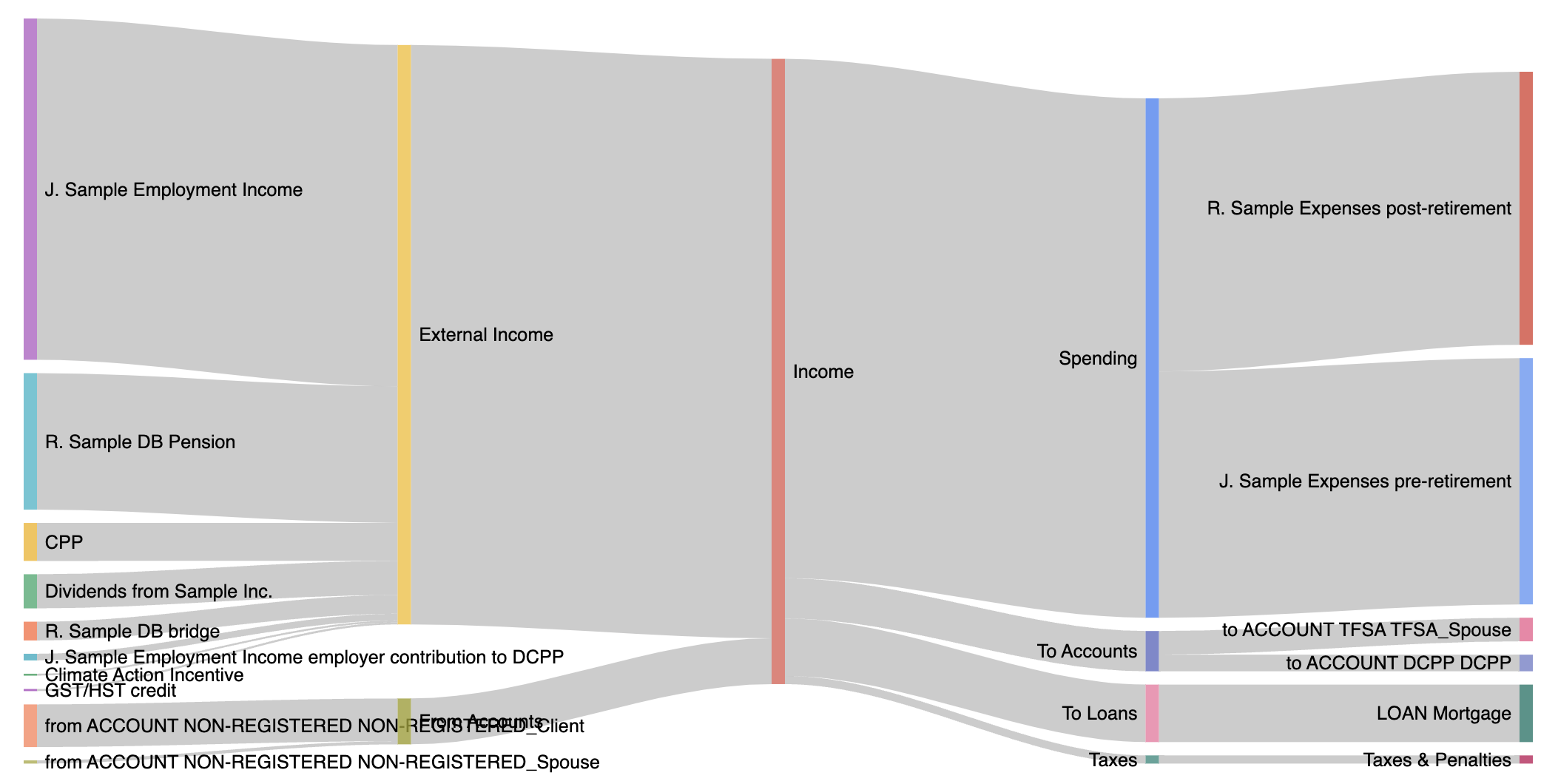

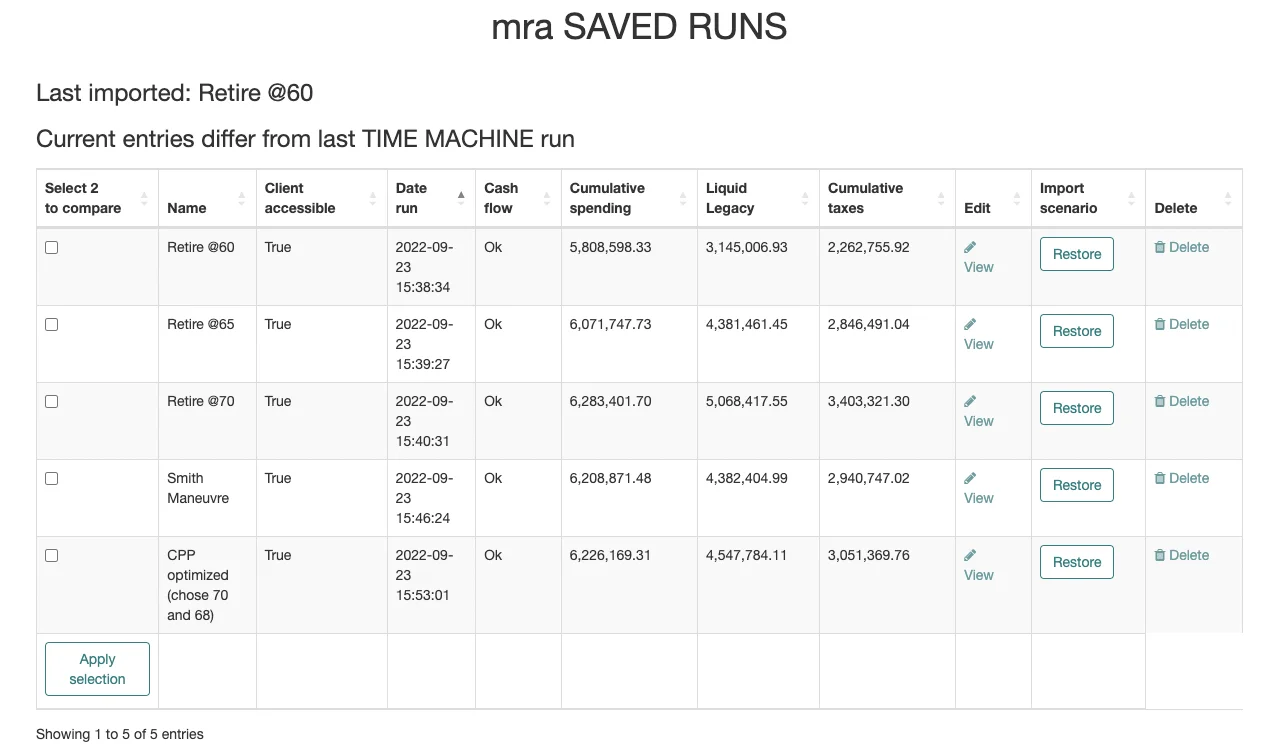

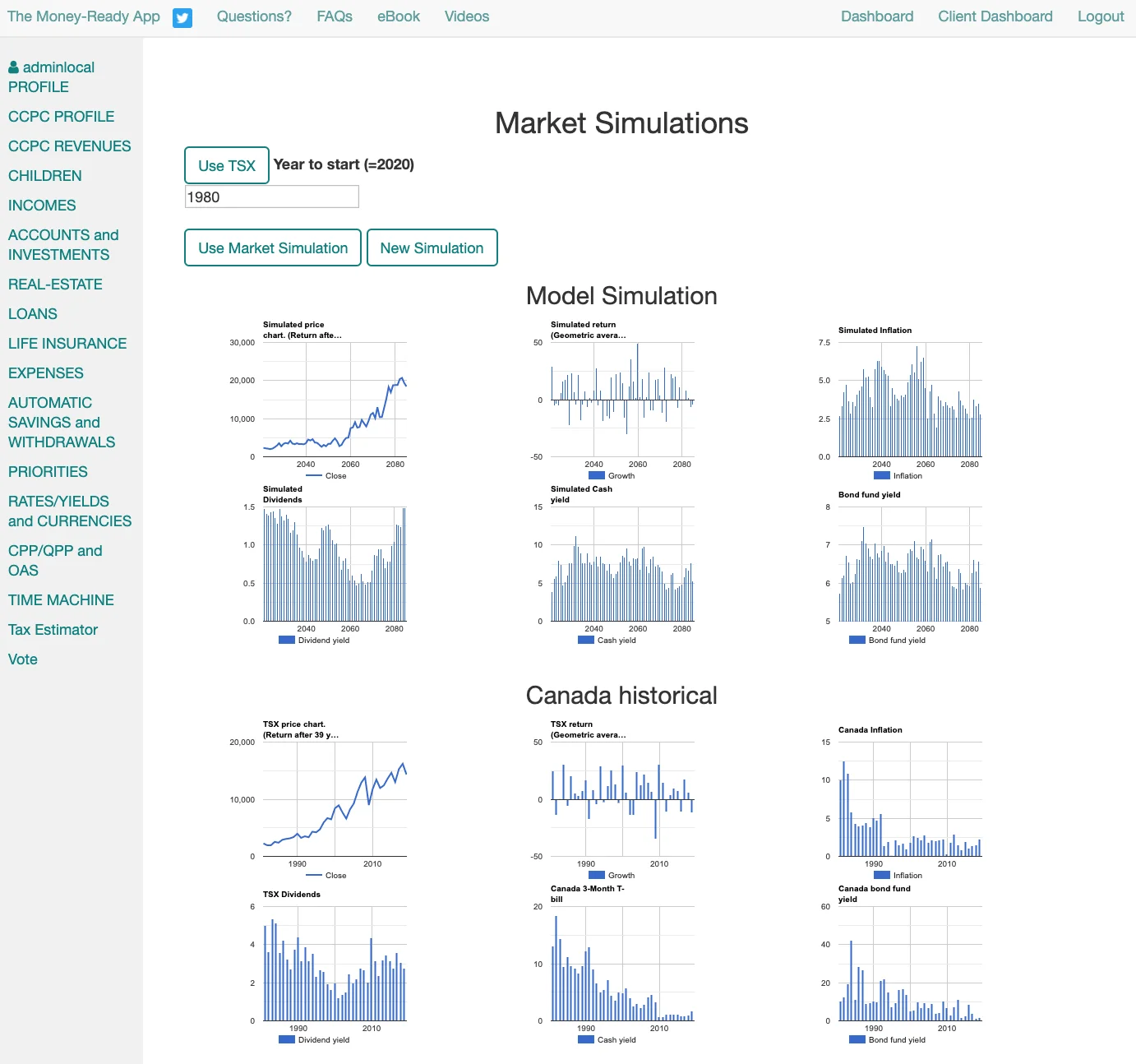

The MoneyReady App allows you to take complete control over your finances. People usually think of financial planning in terms of the investments they choose, but you must also consider taxes, cash flow, debt, savings and drawdown strategies, rebalancing ... These factors can be much more important than investment performance. The MoneyReady App is for all Canadians, no matter their financial net worth, or their previous financial knowledge. It aims to educate people new to financial planning and to empower experts at it.

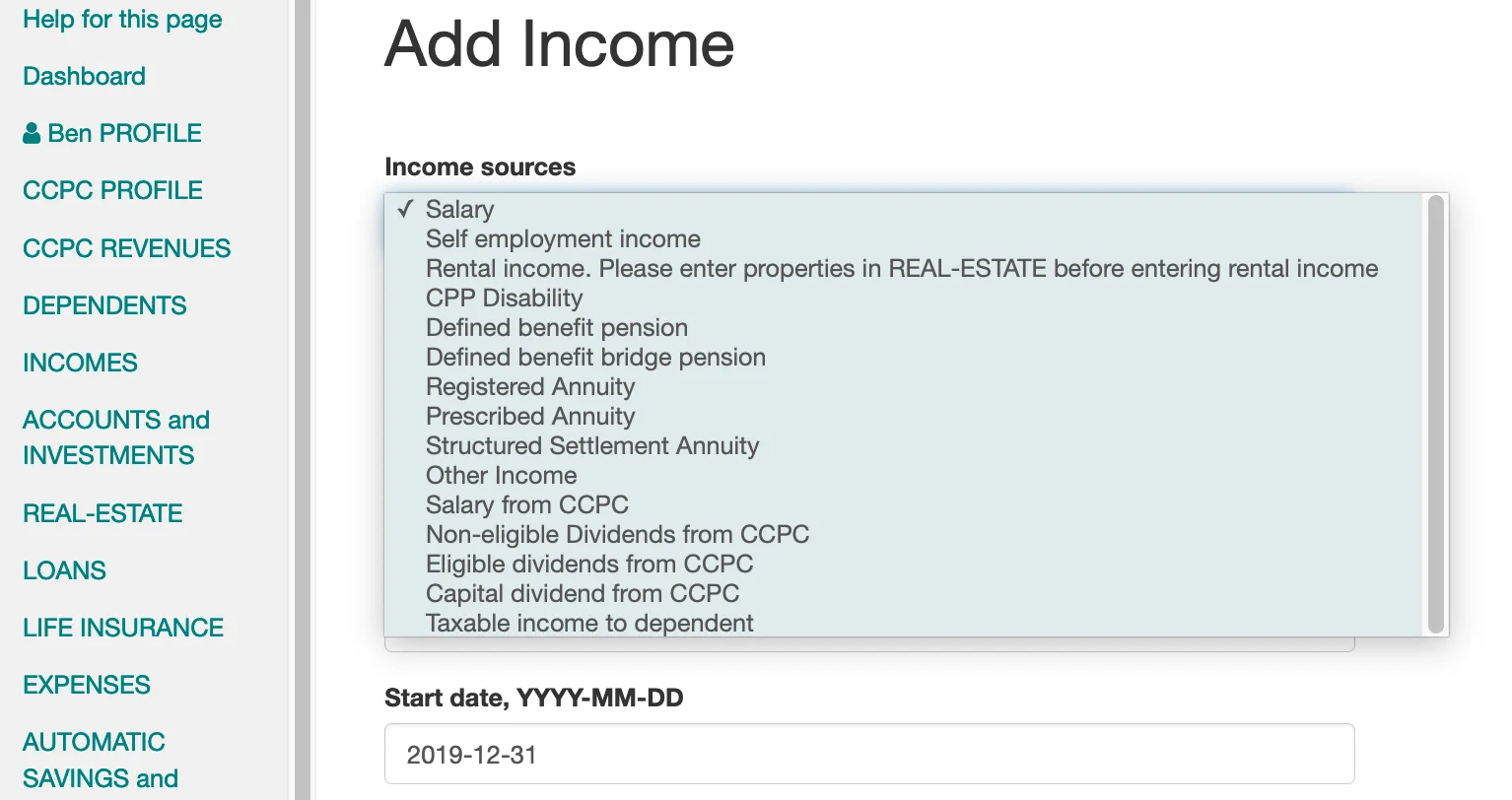

The app is comprehensive and versatile, but only asks what it needs to know given your situation. Like a spouse, it tries to finish your sentences, but it cannot read your mind. It does ask for the inputs needed to make your plans accurate and compliant with current legislation. It does not make hidden assumptions. Therefore the app is only as complicated as is your financial situation.

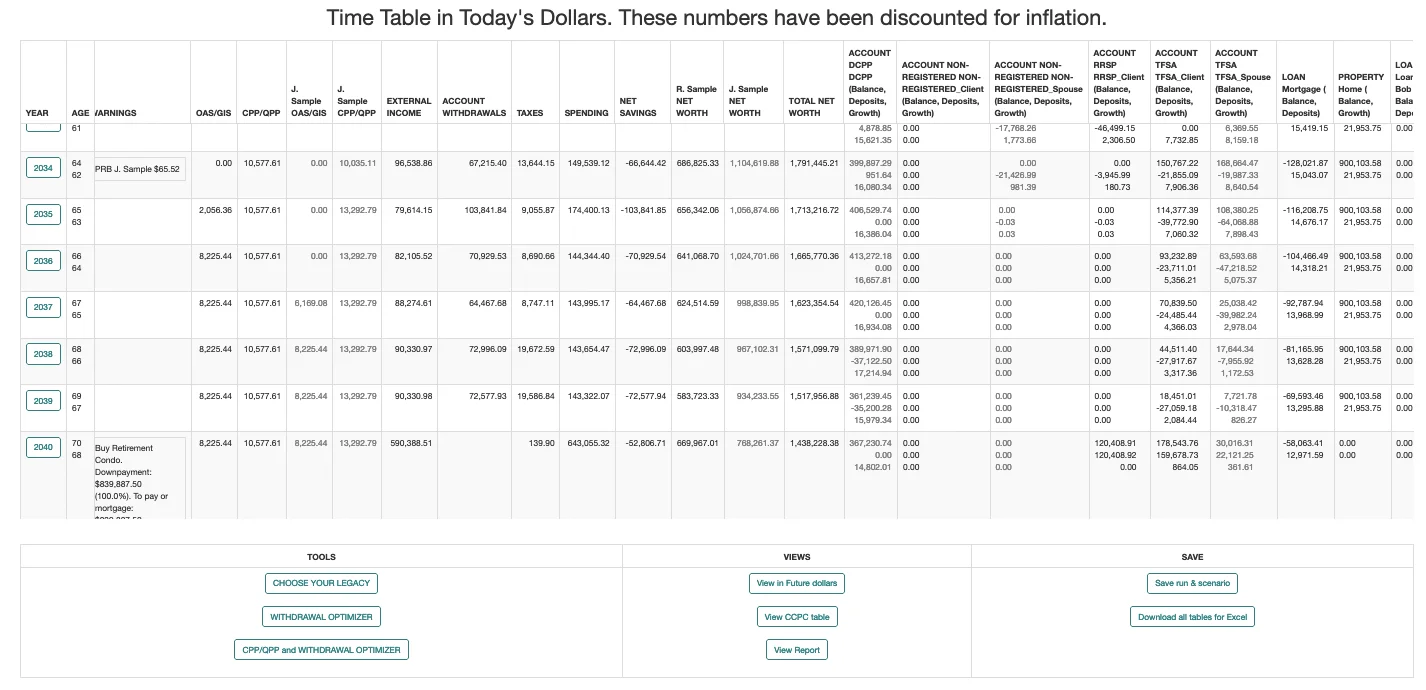

You will learn by doing. You will be better aware of your current financial situation and be able to explore your financial goals. It will help you to learn what you need to know, and once you do, you will find setting up scenarios for the TIME MACHINE simulator easy and even fun!

Extensive help pages are provided throughout the site, and a free eBook is provided.

We are also happy to answer user questions.

Rob Carrick, Globe and Mail

Rob Carrick, Globe and Mail  Bruce Selery, Moolala: Money made simple

Bruce Selery, Moolala: Money made simple