Note: This post was written pre-COVID19 using 2016 data. We implemented most Covid measures in the MoneyReady App when they were announced.

A big part of financial planning is maximizing government benefits and minimizing taxes. The MoneyReadyApp attempts to be complete and accurate. We attempt to cover all Canadians. This is a challenge, because the tax code of Canada is complicated. It is fairly straightforward for the able middle class, but it gets very complicated for the poor, the disabled and the very rich. It seems that the fewer people a tax measure applies to, the more complicated it is. At least that is my hypothesis, based on how difficult it was to implement some tax and benefit calculations in the MoneyReadyApp. There are a few still missing, in particular the calculation of the Lifetime Capital Gains Exemption (LCGE), which is the most convoluted and complicated piece of tax code I have encountered so far. Even if I assumed eligibility (a big if, as there are many rules), the calculation would essentially need the tax returns (T1, Schedule 3, form T657, form T2017, form T936) for the individual claiming it, back to 1985.

This goes against another aim of the MoneyReadyApp which is to make financial planning easy. That is to ask the fewest questions from the user yet still project their taxes and deductions accurately. It also aims to accommodate whatever degree of accuracy a user wants. Some users want to enter every one of their expenses and have every tax credit calculated. Most users just enter an approximate yearly living expense and that’s good enough.

Any tax benefit that you qualify for is of course very important to you. But it got me thinking about how many people does each tax measure affect, and by how much? What are the tax measures I should prioritize to benefit the most Canadians? Am I spending the most time on the measures that affect the least number of people or with small benefits?

I am a scientist by training, and if I have a hypothesis, then I feel obliged to test it. To test it I need data. So I went out looking for data on 3 things:

- The number of people affected by every tax measure

- The dollar benefit to those people

- The difficulty in making the tax claim.

I did find data on #1 and #2. The department of finance publishes a Report on Federal Tax Expenditures every year, with loads of data on federal taxes. I did not find data on #3. I thought it possible to get an approximate, yet objective measure by simply counting the number of words or pages in the tax code that covers the measure, and the number of forms, or lines on the forms; I might attempt to do that at some point.

From the Government’s point of view, a “Tax Expenditure” is any tax that they consider individuals or companies could have paid, but didn’t because of an exemption, tax credit, deduction, rebate, refund, or reduced tax rate. Your tax benefit is their revenue forgone. Even though they didn’t get the money, they consider it as a spent expense for them. I’ll just call them tax breaks.

The Report on Federal Tax Expenditures provides a list of all the tax breaks, and approximately how much they are worth per year. It also provides some comments on how many people, businesses or other entities were affected by the measure. Those data are also approximate and also out of date: they mostly reference numbers from 2016. Nevertheless, I summarized the data to only include totals, and removed entries for which no information was actually available. The result is a table with 99 tax breaks (77 of which apply to individuals). Because the numbers I used were the 2020 projected-dollar values (in order to consider measures that are still in place, although some have been changed) while the number of affected individuals given are mostly for 2016, any analysis and comparison will be wrong in absolute terms. Still, the analysis can help us to rank the measures in different ways.

Table 1 below shows most tax breaks for which data exist on the number of people or entities affected. I show it in full for completeness, since it can be an eye opener. An extended table with a description of each measure is available here

| TAX BREAK MEASURE | Considered in the MoneyReadyApp | Projected 2020 (Millions) | Dollars/claim (Individual) | Dollars/claim (Business or Entity) | Individuals | Businesses or entities |

|---|---|---|---|---|---|---|

| Credit for the Basic Personal Amount | ✔︎ | 38,410 | $1,402 | 27,400,000 | ||

| Registered Pension Plans | ✔︎ | 30,440 | $3,853 | 7,900,000 | ||

| Canada Child Benefit | ✔︎ | 24,700 | $7,265 | 3,400,000 | ||

| Registered Retirement Savings Plans | ✔︎ | 17,515 | $1,968 | 8,900,000 | ||

| Partial inclusion of capital gains | ✔︎ | 17,215 | $3,056 | $43,101 | 2,700,000 | 208,000 |

| Refundable taxes on investment income of private corporations | 12,155 | $48,043 | 253,000 | |||

| Tax treatment of Canada Pension Plan and Quebec Pension Plan contributions and benefits | ✔︎ | 11,050 | $624 | 17,700,000 | ||

| Non-taxation of capital gains on principal residences | ✔︎ | 5,915 | ||||

| Dividend gross-up and tax credit | ✔︎ | 5,650 | $1,487 | 3,800,000 | ||

| Preferential tax rate for small businesses | ✔︎ | 5,575 | $7,316 | 762,000 | ||

| Goods and Services Tax/Harmonized Sales Tax Credit | 4,930 | $470 | 10,500,000 | |||

| Tax treatment of Employment Insurance and Quebec Parental Insurance Plan premiums and benefits | ✔︎ | 4,150 | $208 | 20,000,000 | ||

| Age Credit | ✔︎ | 4,025 | $706 | 5,700,000 | ||

| Charitable Donation Tax Credit | ✔︎ (1) | 3,190 | $580 | 5,500,000 | ||

| Non-taxation of benefits from private health and dental plans | ✔︎ (2) | 3,030 | $235 | 12,900,000 | ||

| Accelerated Investment Incentive | 3,005 | $147 | 631,500 | |||

| Scientific Research and Experimental Development Investment Tax Credit | 2,835 | $250 | $136,957 | 4,000 | 20,700 | |

| Rebate for municipalities | 2,725 | $286,842 | 9,500 | |||

| Canada Employment Credit | 2,505 | $141 | 17,800,000 | |||

| Canada Workers Benefit | ✔︎ | 2,100 | $1,400 | 1,500,000 | ||

| Deduction of interest and carrying charges incurred to earn investment income | ✔︎ | 1,925 | $963 | 2,000,000 | ||

| Spouse or Common-Law Partner Credit | ✔︎ | 1,895 | $902 | 2,100,000 | ||

| Medical Expense Tax Credit | ✔︎ (1) | 1,865 | $373 | 5,000,000 | ||

| Lifetime Capital Gains Exemption | 1,810 | $30,116 | 60,100 | |||

| Tuition Tax Credit | ✔︎ (1) | 1,810 | $754 | 2,400,000 | ||

| Foreign tax credit for individuals | ✔︎ | 1,660 | $1,186 | 1,400,000 | ||

| Pension income splitting | ✔︎ | 1,455 | $1,119 | 1,300,000 | ||

| Child care expense deduction | ✔︎ | 1,445 | $1,032 | 1,400,000 | ||

| Pension Income Credit | ✔︎ | 1,340 | $263 | 5,100,000 | ||

| Tax-Free Savings Account | ✔︎ | 1,315 | $97 | 13,500,000 | ||

| Disability Tax Credit | ✔︎ | 1,190 | $992 | 1,200,000 | ||

| Deduction of union and professional dues | 1,100 | $193 | 5,700,000 | |||

| Deduction of other employment expenses | 1,075 | $1,402 | 767,000 | |||

| Refundable capital gains tax for investment and mutual fund corporations | 1,040 | $16,000,000 | 65 | |||

| Eligible Dependant Credit | ✔︎ | 1,025 | $1,058 | 969,000 | ||

| Rebate for schools, colleges and universities | 930 | $206,667 | 4,500 | |||

| Rebate for hospitals, facility operators and external suppliers | 745 | $1,064,286 | 700 | |||

| Partial deduction of and partial input tax credits for meals and entertainment | ✔︎ (1) | 740 | $277 | $376 | 811,000 | 838,000 |

| Deductibility of charitable donations | 715 | $7,582 | 94,300 | |||

| Employee stock option deduction | ✔︎ | 710 | $20,882 | 34,000 | ||

| Non-taxation of workers’ compensation benefits | ✔︎ (2) | 675 | $1,174 | 575,000 | ||

| Exemption of scholarship, fellowship and bursary income | ✔︎ (2) | 425 | $368 | 1,155,000 | ||

| Rebate for registered charities | 335 | $6,700 | 50,000 | |||

| Non-taxation of social assistance benefits | ✔︎ (2) | 315 | $197 | 1,600,000 | ||

| Film or Video Production Services Tax Credit | 305 | $762,500 | 400 | |||

| Tax treatment of investment income from life insurance policies | ✔︎ | 260 | $12 | 22,000,000 | ||

| Canada Caregiver Credit | ✔︎ | 245 | $544 | 450,000 | ||

| Northern Residents Deductions | 240 | $938 | 256,000 | |||

| Non-taxation of Guaranteed Income Supplement and Allowance benefits | ✔︎ | 235 | $370 | 635,000 | ||

| Registered Education Savings Plans | ✔︎ | 220 | $39 | 5,700,000 | ||

| Non-taxation of capital gains on donations of publicly listed securities | 195 | $17,500 | $107,955 | 6,000 | 880 | |

| Patronage dividend deduction | 190 | $250,000 | 760 | |||

| Education Tax Credit. Eliminated | 190 | $83 | 2,300,000 | |||

| Non-taxation of certain veterans’ benefits | ✔︎ (2) | 180 | $1,636 | 110,000 | ||

| Refundable Medical Expense Supplement | 175 | $311 | 562,000 | |||

| Non-taxation of non-profit organizations | 170 | $6,464 | 26,300 | |||

| Non-taxation of payments to Canadian Armed Forces members and veterans in respect of pain and suffering | ✔︎ (2) | 170 | $2,429 | 70,000 | ||

| Labour-Sponsored Venture Capital Corporations Credit | 170 | $535 | 318,000 | |||

| Atlantic Investment Tax Credit | 160 | $2,128 | $24,786 | 4,700 | 5,850 | |

| Flow-through share deductions | 150 | $2,558 | $114,286 | 43,000 | 350 | |

| Moving expense deduction | 125 | $1,330 | 94,000 | |||

| First-Time Home Buyers’ Tax Credit | 110 | $558 | 197,000 | |||

| Deduction for clergy residence | ✔︎ (1) | 100 | $3,774 | 26,500 | ||

| Apprenticeship Job Creation Tax Credit | 100 | $1,000 | $8,000 | 1,000 | 12,500 | |

| Tax treatment of alimony and maintenance payments | ✔︎(1)(2) | 95 | $1,532 | 62,000 | ||

| Registered Disability Savings Plans | ✔︎ | 85 | $472 | 180,000 | ||

| Rebate for qualifying non-profit organizations | 75 | $9,375 | 8,000 | |||

| Mineral Exploration Tax Credit for flow-through share investors | 65 | $6,500 | 10,000 | |||

| Deductibility of contributions to a qualifying environmental trust | 60 | $1,200,000 | 50 | |||

| Student Loan Interest Credit | ✔︎ | 45 | $84 | 537,000 | ||

| Non-taxation of RCMP pensions and other compensation in respect of injury, disability or death | ✔︎ (2) | 40 | $2,857 | 14,000 | ||

| Deferral through 10-year capital gain reserve | 35 | $3,804 | 9,200 | |||

| Deduction of allowable business investment losses | 35 | $2,469 | $8,242 | 8,100 | 1,820 | |

| Holdback on progress payments to contractors | 30 | $4,762 | 6,300 | |||

| Textbook Tax Credit. Eliminated | 30 | $13 | 2,300,000 | |||

| Corporate Mineral Exploration and Development Tax Credit | 25 | $1,000,000 | 25 | |||

| Home Accessibility Tax Credit | 25 | $893 | 28,000 | |||

| Political Contribution Tax Credit | 25 | $170 | 147,000 | |||

| Exemption from branch tax for transportation, communications, and iron ore mining corporations | 20 | $1,000,000 | 20 | |||

| Volunteer Firefighters Tax Credit | 20 | $465 | 43,000 | |||

| Rebate for book purchases made by certain organizations | 15 | $7,500 | 2,000 | |||

| Deferral through five-year capital gain reserve | 10 | $1,235 | 8,100 | |||

| Refunds for Indigenous self-governments | 5 | $166,667 | 30 | |||

| Patronage dividends paid as shares by agricultural cooperatives | 5 | $125,000 | 40 | |||

| Non-taxation of capital gains on donations of cultural property | 5 | $12,500 | 400 | |||

| Rollovers of investments in small businesses | 5 | $4,545 | 1,100 | |||

| Non-taxation of up to $10,000 of death benefits | 5 | $714 | 7,000 | |||

| Teacher and Early Childhood Educator School Supply Tax Credit | 5 | $106 | 47,000 | |||

| Disability supports deduction | ✔︎ | 3 | $1,154 | 2,600 | ||

| Apprentice vehicle mechanics’ tools deduction | 3 | $441 | 6,800 | |||

| Tax-free amount for emergency services volunteers | 3 | $150 | 20,000 | |||

| Adoption Expense Tax Credit | 2 | $1,053 | 1,900 | |||

| Search and Rescue Volunteers Tax Credit | 2 | $417 | 4,800 | |||

| Deduction for tuition assistance for adult basic education | 2 | $333 | 6,000 | |||

| Deduction for tradespeople’s tool expenses | 2 | $100 | 20,000 | |||

| Deductibility of earthquake reserves | 1 | $50,000 | 20 | |||

| Special tax computation for certain retroactive lump-sum payments | 1 | $2,000 | 500 | |||

| Logging Tax Credit | 1 | $2,000 | $72,289 | 500 | 830 | |

| Deductibility of certain costs incurred by musicians | 1 | $313 | 3,200 |

A ✔︎ indicates the MoneyReadyApp considers the measure automatically without additional input from the user. A ✔︎(1) means the MoneyReadyApp will automatically consider the measure if you enter the appropriate expense (optional). For expenses with no ✔︎(1), you can still enter them if you want to keep an extensive budget in the app, but you will need to reduce them by the tax credit yourself. A ✔︎(2) means you can enter the income (or appropriate portion) as Non-taxable.

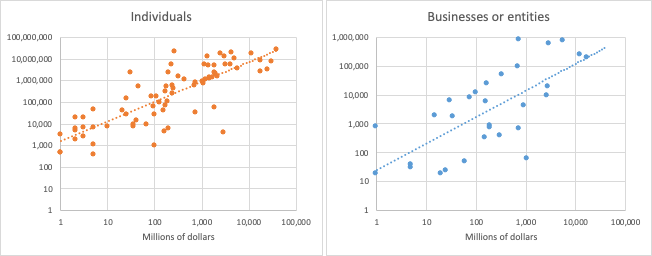

Plotting the data, we see that every million dollars in tax breaks affects about 1000 individuals. Businesses are more expensive, but the measures presumably affect the individuals tied to the business (as owners, shareholders and/or employees). Also note for businesses that the number of businesses counted are only those that are incorporated. There is a lot of scatter in these plots. Some points are way below the fitted line, indicating measures that are expensive to the government, given how few people they benefit, and some are way above the fitted line, which indicate measures that are relatively cheap to the government in terms of the number of people helped. Not to be overly political, but substitute the word “people” with the word “voter”, and reinterpret the graph accordingly.

Figure 1

Because the MoneyReadyApp deals with individuals, we will analyse these measures some more. In our list, there are tax breaks that impact over a million Canadians per year. These are shown in Table 2.

| TAX BREAK MEASURE | Considered in the MoneyReadyApp | Projected 2020 (Millions) | Dollars/claim (Individual) | Individuals |

|---|---|---|---|---|

| Credit for the Basic Personal Amount | ✔︎ | 38,410 | $1,402 | 27,400,000 |

| Tax treatment of investment income from life insurance policies | ✔︎ | 260 | $12 | 22,000,000 |

| Tax treatment of Employment Insurance and Quebec Parental Insurance Plan premiums and benefits | ✔︎ | 4,150 | $208 | 20,000,000 |

| Canada Employment Credit | 2,505 | $141 | 17,800,000 | |

| Tax treatment of Canada Pension Plan and Quebec Pension Plan contributions and benefits | ✔︎ | 11,050 | $624 | 17,700,000 |

| Tax-Free Savings Account | ✔︎ | 1,315 | $97 | 13,500,000 |

| Non-taxation of benefits from private health and dental plans | ✔︎ (2) | 3,030 | $235 | 12,900,000 |

| Goods and Services Tax/Harmonized Sales Tax Credit | 4,930 | $470 | 10,500,000 | |

| Registered Retirement Savings Plans | ✔︎ | 17,515 | $1,968 | 8,900,000 |

| Registered Pension Plans | ✔︎ | 30,440 | $3,853 | 7,900,000 |

| Age Credit | ✔︎ | 4,025 | $706 | 5,700,000 |

| Deduction of union and professional dues | 1,100 | $193 | 5,700,000 | |

| Registered Education Savings Plans | ✔︎ | 220 | $39 | 5,700,000 |

| Charitable Donation Tax Credit | ✔︎ (1) | 3,190 | $580 | 5,500,000 |

| Pension Income Credit | ✔︎ | 1,340 | $263 | 5,100,000 |

| Medical Expense Tax Credit | ✔︎ (1) | 1,865 | $373 | 5,000,000 |

| Dividend gross-up and tax credit | ✔︎ | 5,650 | $1,487 | 3,800,000 |

| Canada Child Benefit | ✔︎ | 24,700 | $7,265 | 3,400,000 |

| Partial inclusion of capital gains | ✔︎ | 17,215 | $3,056 | 2,700,000 |

| Tuition Tax Credit | ✔︎ (1) | 1,810 | $754 | 2,400,000 |

| Education Tax Credit. Eliminated | 190 | $83 | 2,300,000 | |

| Textbook Tax Credit. Eliminated | 30 | $13 | 2,300,000 | |

| Spouse or Common-Law Partner Credit | ✔︎ | 1,895 | $902 | 2,100,000 |

| Deduction of interest and carrying charges incurred to earn investment income | ✔︎ | 1,925 | $963 | 2,000,000 |

| Non-taxation of social assistance benefits | ✔︎ (2) | 315 | $197 | 1,600,000 |

| Canada Workers Benefit | ✔︎ | 2,100 | $1,400 | 1,500,000 |

| Foreign tax credit for individuals | ✔︎ | 1,660 | $1,186 | 1,400,000 |

| Child care expense deduction | ✔︎ | 1,445 | $1,032 | 1,400,000 |

| Pension income splitting | ✔︎ | 1,455 | $1,119 | 1,300,000 |

| Disability Tax Credit | ✔︎ | 1,190 | $992 | 1,200,000 |

| Exemption of scholarship, fellowship and bursary income | ✔︎ (2) | 425 | $368 | 1,155,000 |

| Eligible Dependant Credit | ✔︎ | 1,025 | $1,058 | 969,000 |

| Partial deduction of and partial input tax credits for meals and entertainment | ✔︎ (1) | 740 | $277 | 811,000 |

| Deduction of other employment expenses | 1,075 | $1,402 | 767,000 | |

| Non-taxation of Guaranteed Income Supplement and Allowance benefits | ✔︎ | 235 | $370 | 635,000 |

| Non-taxation of workers’ compensation benefits | ✔︎ (2) | 675 | $1,174 | 575,000 |

| Refundable Medical Expense Supplement | 175 | $311 | 562,000 | |

| Student Loan Interest Credit | ✔︎ | 45 | $84 | 537,000 |

| Canada Caregiver Credit | ✔︎ | 245 | $544 | 450,000 |

| Labour-Sponsored Venture Capital Corporations Credit | 170 | $535 | 318,000 | |

| Northern Residents Deductions | 240 | $938 | 256,000 | |

| First-Time Home Buyers’ Tax Credit | 110 | $558 | 197,000 | |

| Registered Disability Savings Plans | ✔︎ | 85 | $472 | 180,000 |

| Political Contribution Tax Credit | 25 | $170 | 147,000 | |

| Non-taxation of certain veterans’ benefits | ✔︎ (2) | 180 | $1,636 | 110,000 |

| Moving expense deduction | 125 | $1,330 | 94,000 | |

| Non-taxation of payments to Canadian Armed Forces members and veterans in respect of pain and suffering | ✔︎ (2) | 170 | $2,429 | 70,000 |

| Tax treatment of alimony and maintenance payments | ✔︎(1)(2) | 95 | $1,532 | 62,000 |

| Lifetime Capital Gains Exemption | 1,810 | $30,116 | 60,100 | |

| Teacher and Early Childhood Educator School Supply Tax Credit | 5 | $106 | 47,000 | |

| Flow-through share deductions | 150 | $2,558 | 43,000 | |

| Volunteer Firefighters Tax Credit | 20 | $465 | 43,000 | |

| Employee stock option deduction | ✔︎ | 710 | $20,882 | 34,000 |

| Home Accessibility Tax Credit | 25 | $893 | 28,000 | |

| Deduction for clergy residence | ✔︎ (1) | 100 | $3,774 | 26,500 |

| Tax-free amount for emergency services volunteers | 3 | $150 | 20,000 | |

| Deduction for tradespeople’s tool expenses | 2 | $100 | 20,000 | |

| Non-taxation of RCMP pensions and other compensation in respect of injury, disability or death | ✔︎ (2) | 40 | $2,857 | 14,000 |

| Mineral Exploration Tax Credit for flow-through share investors | 65 | $6,500 | 10,000 | |

| Deferral through 10-year capital gain reserve | 35 | $3,804 | 9,200 | |

| Deduction of allowable business investment losses | 35 | $2,469 | 8,100 | |

| Deferral through five-year capital gain reserve | 10 | $1,235 | 8,100 | |

| Non-taxation of up to $10,000 of death benefits | 5 | $714 | 7,000 | |

| Apprentice vehicle mechanics’ tools deduction | 3 | $441 | 6,800 | |

| Non-taxation of capital gains on donations of publicly listed securities | 195 | $17,500 | 6,000 | |

| Deduction for tuition assistance for adult basic education | 2 | $333 | 6,000 | |

| Search and Rescue Volunteers Tax Credit | 2 | $417 | 4,800 | |

| Atlantic Investment Tax Credit | 160 | $2,128 | 4,700 | |

| Scientific Research and Experimental Development Investment Tax Credit | 2,835 | $250 | 4,000 | |

| Deductibility of certain costs incurred by musicians | 1 | $313 | 3,200 | |

| Disability supports deduction | ✔︎ | 3 | $1,154 | 2,600 |

| Adoption Expense Tax Credit | 2 | $1,053 | 1,900 | |

| Rollovers of investments in small businesses | 5 | $4,545 | 1,100 | |

| Apprenticeship Job Creation Tax Credit | 100 | $1,000 | 1,000 | |

| Special tax computation for certain retroactive lump-sum payments | 1 | $2,000 | 500 | |

| Logging Tax Credit | 1 | $2,000 | 500 | |

| Non-taxation of capital gains on donations of cultural property | 5 | $12,500 | 400 | |

We can calculate the ratio of dollars per individual to see which are the most valuable tax breaks to individuals. The tax breaks that affected a minimum of 10,000 Canadians in 2016 are given sorted in descending order of the claim value (Table 3)

| TAX BREAK MEASURE | Considered in the MoneyReadyApp | Projected 2020 (Millions) | Dollars/claim (Individual) | Individuals |

|---|---|---|---|---|

| Lifetime Capital Gains Exemption | 1,810 | $30,116 | 60,100 | |

| Employee stock option deduction | ✔︎ | 710 | $20,882 | 34,000 |

| Canada Child Benefit | ✔︎ | 24,700 | $7,265 | 3,400,000 |

| Mineral Exploration Tax Credit for flow-through share investors | 65 | $6,500 | 10,000 | |

| Registered Pension Plans | ✔︎ | 30,440 | $3,853 | 7,900,000 |

| Deduction for clergy residence | ✔︎ (1) | 100 | $3,774 | 26,500 |

| Partial inclusion of capital gains | ✔︎ | 17,215 | $3,056 | 2,700,000 |

| Non-taxation of RCMP pensions and other compensation in respect of injury, disability or death | ✔︎ (2) | 40 | $2,857 | 14,000 |

| Flow-through share deductions | 150 | $2,558 | 43,000 | |

| Non-taxation of payments to Canadian Armed Forces members and veterans in respect of pain and suffering | ✔︎ (2) | 170 | $2,429 | 70,000 |

| Registered Retirement Savings Plans | ✔︎ | 17,515 | $1,968 | 8,900,000 |

| Non-taxation of certain veterans’ benefits | ✔︎ (2) | 180 | $1,636 | 110,000 |

| Tax treatment of alimony and maintenance payments | ✔︎(1)(2) | 95 | $1,532 | 62,000 |

| Dividend gross-up and tax credit | ✔︎ | 5,650 | $1,487 | 3,800,000 |

| Credit for the Basic Personal Amount | ✔︎ | 38,410 | $1,402 | 27,400,000 |

| Deduction of other employment expenses | 1,075 | $1,402 | 767,000 | |

| Canada Workers Benefit | ✔︎ | 2,100 | $1,400 | 1,500,000 |

| Moving expense deduction | 125 | $1,330 | 94,000 | |

| Foreign tax credit for individuals | ✔︎ | 1,660 | $1,186 | 1,400,000 |

| Non-taxation of workers’ compensation benefits | ✔︎ (2) | 675 | $1,174 | 575,000 |

| Pension income splitting | ✔︎ | 1,455 | $1,119 | 1,300,000 |

| Eligible Dependant Credit | ✔︎ | 1,025 | $1,058 | 969,000 |

| Child care expense deduction | ✔︎ | 1,445 | $1,032 | 1,400,000 |

| Disability Tax Credit | ✔︎ | 1,190 | $992 | 1,200,000 |

| Deduction of interest and carrying charges incurred to earn investment income | ✔︎ | 1,925 | $963 | 2,000,000 |

| Northern Residents Deductions | 240 | $938 | 256,000 | |

| Spouse or Common-Law Partner Credit | ✔︎ | 1,895 | $902 | 2,100,000 |

| Home Accessibility Tax Credit | 25 | $893 | 28,000 | |

| Tuition Tax Credit | ✔︎ (1) | 1,810 | $754 | 2,400,000 |

| Age Credit | ✔︎ | 4,025 | $706 | 5,700,000 |

| Tax treatment of Canada Pension Plan and Quebec Pension Plan contributions and benefits | ✔︎ | 11,050 | $624 | 17,700,000 |

| Charitable Donation Tax Credit | ✔︎ (1) | 3,190 | $580 | 5,500,000 |

| First-Time Home Buyers’ Tax Credit | 110 | $558 | 197,000 | |

| Canada Caregiver Credit | ✔︎ | 245 | $544 | 450,000 |

| Labour-Sponsored Venture Capital Corporations Credit | 170 | $535 | 318,000 | |

| Registered Disability Savings Plans | ✔︎ | 85 | $472 | 180,000 |

| Goods and Services Tax/Harmonized Sales Tax Credit | 4,930 | $470 | 10,500,000 | |

| Volunteer Firefighters Tax Credit | 20 | $465 | 43,000 | |

| Medical Expense Tax Credit | ✔︎ (1) | 1,865 | $373 | 5,000,000 |

| Non-taxation of Guaranteed Income Supplement and Allowance benefits | ✔︎ | 235 | $370 | 635,000 |

| Exemption of scholarship, fellowship and bursary income | ✔︎ (2) | 425 | $368 | 1,155,000 |

| Refundable Medical Expense Supplement | 175 | $311 | 562,000 | |

| Partial deduction of and partial input tax credits for meals and entertainment | ✔︎ (1) | 740 | $277 | 811,000 |

| Pension Income Credit | ✔︎ | 1,340 | $263 | 5,100,000 |

| Non-taxation of benefits from private health and dental plans | ✔︎ (2) | 3,030 | $235 | 12,900,000 |

| Tax treatment of Employment Insurance and Quebec Parental Insurance Plan premiums and benefits | ✔︎ | 4,150 | $208 | 20,000,000 |

| Non-taxation of social assistance benefits | ✔︎ (2) | 315 | $197 | 1,600,000 |

| Deduction of union and professional dues | 1,100 | $193 | 5,700,000 | |

| Political Contribution Tax Credit | 25 | $170 | 147,000 | |

| Tax-free amount for emergency services volunteers | 3 | $150 | 20,000 | |

| Canada Employment Credit | 2,505 | $141 | 17,800,000 | |

| Teacher and Early Childhood Educator School Supply Tax Credit | 5 | $106 | 47,000 | |

| Deduction for tradespeople’s tool expenses | 2 | $100 | 20,000 | |

| Tax-Free Savings Account | ✔︎ | 1,315 | $97 | 13,500,000 |

| Student Loan Interest Credit | ✔︎ | 45 | $84 | 537,000 |

| Education Tax Credit. Eliminated | 190 | $83 | 2,300,000 | |

| Registered Education Savings Plans | ✔︎ | 220 | $39 | 5,700,000 |

| Textbook Tax Credit. Eliminated | 30 | $13 | 2,300,000 | |

| Tax treatment of investment income from life insurance policies | ✔︎ | 260 | $12 | 22,000,000 |

And there it is, right at the top, the LCGE. Claimed by 60,100 individuals in 2016, each claiming around $25,000 on average that year.

One thing I noted previously is how costly RRSPs are to the government. I’m often asked if RRSPs are worth it, because you get a tax break when you contribute and enjoy tax free growth, but you are taxed on the withdrawals. The amount shown in the table for RRSPs already accounts for the taxes recuperated upon withdrawal. The positive number indicates that the government has a net expense. Thus, on average, Canadians are benefiting. But because only averages are shown, you should not use this fact for your own personal financial planning, since everyone’s situation is unique to them.

I did this analysis to determine what deductions I should focus on implementing next in the MoneyReadyApp. As you see, the app already deals with most of them, but there are some missing. As I mentioned earlier, the LCGE is hard, but the Northern resident deduction shouldn’t be so bad. I’m thinking that I might need to do this analysis for all of the provincial tax breaks also, to find any more low-hanging fruit not already covered by the MoneyReadyApp (it does cover many provincial tax breaks already).

If a tax break isn’t implemented in the MoneyReadyApp, then the results that you get from a TIME MACHINE run will make you look a little poorer. Tax breaks come and go with different governments, and you want to create a financial plan that is not too dependent on them anyway.

I thought I’d share this analysis on my blog because I think the data are interesting and you might too. You can also see a glimpse of the MoneyReadyApp’s inner workings and how I am striving to bring Canadians the most accurate, complete, easy, and affordable financial planning tool.