admin

Administrator

Today I'm happy to announce parameter SCANS for the TIME MACHINE.

To explore the effects of systematically changing one or more of the many parameters you have entered in your scenario for the TIME MACHINE, we now allow SCANS. In addition to the 6 saved runs that you can have at a time, we also allow you to save up to 6 SCANS at a time. Each scan can contain up to 101 runs.

In a scan, you can vary most values for most of the entities you have entered in your scenario. You will first select the type of entity from a drop-down list (e.g., EXPENSES, INCOMES, INVESTMENTS, etc.), and then select the entity (e.g., the EXPENSE) and the kind of values that apply to that entity (amount, percentage, date, etc.). You then enter a starting value, an increment value (which can be negative for a decrement), and a stop value. For dates, the increment is in full years. A TIME MACHINE run will be done for each value of that parameter, keeping everything else constant in your scenario.

Because different parameters often move in tandem, you can add additional parameters in exactly the same way. Although there is no limit to the number of parameters you can add, there is a limit to the total number of runs (100) we allow per SCAN. Each parameter is linked to the others, and the final number of runs will also be determined by the parameter with the fewest scan values. You will be able to see a table of the values that will be used for each run to confirm that you have set up the SCAN as you want before actually running it. The last run that will be done is for your current unmodified scenario.

For example: Say you have quotes for different term life insurance values. You can get a $100,000 death benefit for a $1,000/year premium, and every additional $100,000 of coverage costs $1,000/year. To set up this SCAN, you would select INSURANCE from the first dropdown, then select "death benefit" from the second. To explore a death benefit from $100,000 to $1,000,000 in $100,000 increments, the starting value would be $100,000, the increment $100,000, and the stop value $1,000,000. Once those are entered you can `Save and add a parameter'.

Again you would select INSURANCE from the first dropdown, then select "premium" from the second. The starting value would then be $1000 and the increment $1000. The stop value for a million dollars of coverage would be $10,000 in this case. If you enter a stop value less than that, say $8,000, the last run would be for $800,000 of coverage not a million. If you enter a stop value that is higher than $10,000, the runs will still stop when the stop on the death benefit is reached. In other words, the first of the stop conditions to be reached ends the run.

Here’s another more complicated example: Say you just received your statement from your defined benefit pension plan. It shows you how much you will get in pension income and bridge benefits if you start your pension at 55, 60, 65, and 70. You are considering when to retire and wish to explore those options. You would select the PROFILE table, and then set the start date of retirement. Set a starting date at your retirement date, increment 5 as dates are incremented in years, and stop value of your retirement date at age 70. Because you have linked INCOMES, EXPENSES, and SAVINGS to your retirement date, the TIME MACHINE will automatically also adjust the start/end dates for those entries as well. You would then add the parameter for the table INCOMES and select the pension you've entered. You would add the value for the pension from your statement at 55, then for the increment enter the difference between the value at 60 and 55. You can add a very high value for the stop as the runs will stop after 4 runs anyway due to the date of retirement parameter. The pension may not increase linearly, however, so the increment may only be approximate in the SCAN; you can always run another TIME MACHINE with a more accurate value once you have narrowed down your options. You can then add another parameter for the bridge pension in the same way as for the pension. The TIME MACHINE will not pay out a bridge pension after 65 anyway, so again you can set a very high number for the stop value.

When the runs are finished, you will see a table with some stats (total taxes paid, legacy, to estate, etc.) for each of the runs in a given SCAN, similar to your list of saved runs. You will be able to view each one and compare them pairwise. Just like saved runs, you can restore its scenario. SCAN runs have an automatic description added to them that shows the values of the parameters used in that run. Its name is just the TIME MACHINE run number. You can modify the name and the description if you want.

SCANS are a little dangerous because there is little or no checking of your inputs at this level. You may be instructing the TIME MACHINE into a parameter space that is disallowed for whatever reason (a loan can't be amortized for example), and it may even crash. If there is a crash, the scans should continue running, but you won't get the results of any run that crashed.

Your list of saved runs now has an extra table with the list of SCANS. You can click on a scan to view it. SCANS have an automatic description added with the inputs that you entered for that scan. You can add additional information in the description. Changing the description will not change the parameters, you need to set up a new scan to do that. For advisors, note that SCANS and their results will be visible to clients by default. You can remove that permission for any scan by unchecking `Allow client to view results' where you go to edit the SCAN name and description.

You can re-run a SCAN on your current scenario. The SCAN's previous runs will be deleted and replaced with the new runs. For example, you could change the age of death in your scenario, and re-run the life insurance scan for that age of death. Or you can just re-run a scan in a few months with updated values of your accounts and other entities. To avoid crashes, make sure the parameters of the scan are still applicable to the updated scenario.

This feature is included with any subscription. Let me know if you have any questions or feedback.

Enjoy!

Hi everyone,

For completeness, I just wanted to catch up on some recent changes that were either already announced in the other forums or are fairly minor.

- The REPORT now includes a Table of Contents. It has links to navigate the report on the web or the pdf.

- Taxes in the year reports are now broken down by federal, province/territory, CPP, and EI contributions.

- The Sample report pdf download has been updated.

- Joint (Not Really) accounts. Useful for Non-Registered accounts that are Joint to avoid probate, but are used as individual accounts to avoid attribution rules and simplify tax filing.

- CPP/QPP Death Benefit. It will only be calculated if you have not already started taking CPP/QPP.

- Union dues have been added to the list of deductible EXPENSES.

- If you have already started U.S. Social Security benefits. If you or your spouse are also currently receiving WEP (including CPP/QPP) or GPO pensions, we now ask you for the amount of the U.S. Social Security benefits you are receiving. This allows for the calculation of the WEP and GPO amounts that were used by the SSA to calculate your benefits (including spousal benefits). The TIME MACHINE will update the amounts as required should you have set further WEP or GPO pensions to be started in the future and will update your benefit calculations.

The TIME MACHINE Year reports now have subtotals by expense type (when specified), income type, and account type. You can now get all the years together in a single report. This extensive report, in both today's and future dollars, is now included as new worksheets in the Excel download.

You can view only a selection of the years. That is the same cash-flow report that is included in the REPORT for printing or pdf download.

A new summary cash-flow report is now also available. For every year, it shows the Cash In totals of EXTERNAL INCOME and ACCOUNT WITHDRAWALs by account type. The Cash Out columns show the total spending, total taxes, and ACCOUNT DEPOSITS by account type. The Net-savings are also shown. The cells are coloured with a heat map to help you see exceptionally low and high amounts.

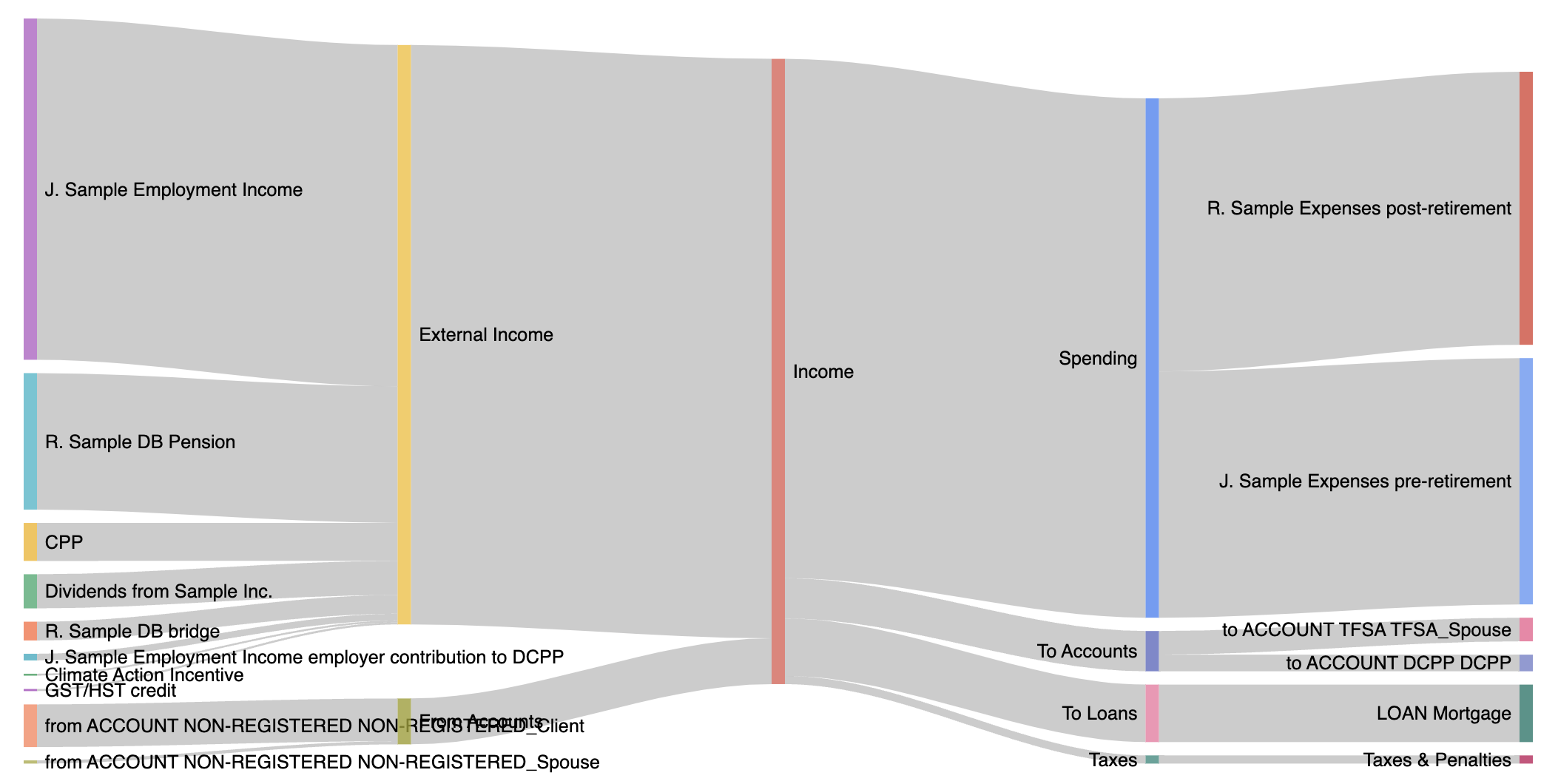

Although these reports are available for older runs including saved runs, those may not show all the subtotals. Also if you've entered a lot of EXPENSE entries, you may want to add an expense type for them if you haven't already. This way you'll see their subtotals in the reports, and it will also make the Sankey diagram in the year report a lot cleaner.

You can get to any of these larger reports from the Views section below any TIME MACHINE Timetable, or from the Year report (click on any year in the Timetable).

Let me know if you have any issues, questions, or suggestions.

Elisabeth

Here's what the summary cash-flow report looks like:

The account rebalancing procedure used by our rebalancing tool and the TIME MACHINE now considers risk-adjusted expected returns rather than simply expected returns.

For that to work optimally, you need to have entered risk values for all your investments. To make that easy, we expanded the 'Change the expected rates of return for all investments by their asset classes' feature again. We've added a checkbox that when checked will also automatically set the risk value for each investment. If we can calculate the 3-year volatility for the investment from the FUNData market data for that investment, the risk measure on our scale of 1 to 20 will be used. If not, an approximate risk measure based on the investment's asset classes will be set.

The risk measure will also be set automatically when you enter new investments either manually or when first imported from Wealthica.

I like to start the year by reflecting on the one past, and 2023 was absolutely fantastic for the MoneyReady App by every metric we have: traffic, registrations, subscriptions, and renewals. It's all from word of mouth, we didn't do any advertising.

I want to thank all of you who have supported the app not only with your paid subscriptions that keep the lights on, but also your referrals, and your feedback. I always find your feedback very useful so thank you for taking the time to reach out through the Forum or the Contact page.

I am continually improving the app and adding features and I want to particularly thank the people who have asked for features directly, or simply through their questions, feedback, and interesting discussions, that inspired me to write new or to improve features.

Here is the list of new features and enhancements we announced last year with the Money Ready Forum usernames of the people I particularly want to thank.

January 2023:

• 100 Monte-Carlo simulations. (understandingTermite8)

• If you have started or applied for U.S. Social Security benefits. (forcefulFerret1)

• Foreign currencies for REVENUES, INCOMES, EXPENSES, and AUTOMATIC SAVINGS/WITHDRAWALS. (enlightenedSyrup4, forcefulFerret1)

• A model for the USD/CAD exchange rate was added to the Market simulations. (forcefulFerret1)

March 2023:

• The MoneyReady Forum. (SheltieLover)

• Accurate GIS calculations when reduced OAS eligibility. (enchantedTermite7)

April 2023:

• Implementation of changes to the QPP starting in 2024.

• Ability to take CPP in Québec and QPP outside of Québec. (niceBumblebeeburritos8)

• EXPENSE Types, Subtypes, and Subtotals. (forcefulFerret1)

May 2023:

• CPP/QPP and OAS start age including months.

• Added a multiplier option to inflation for indexing. (immenseMuesli9)

June 2023:

• OpenAI searching of all MoneyReady documentation. (WanderingMonkey)

• Repeating EXPENSEs date picker. (brilliantChile0, forcefulFerret1)

October 2023:

• We’ve added support for Family RESPs and now allow multiple Individual RESPs for the same beneficiary. (communicativeTuna7)

• New Cash-flow Sankey diagrams in the year reports. (gregariousDotterel1)

November 2023:

• Notification emails from the MoneyReady Forum. (SheltieLover)

• ChatTVM: use AI for solving Time Value of Money problems.

December 2023:

• Rates for Short-term and Long-term financial planning. (sincereFish9)

If you use and like any of these features, I wanted to give all the credit to the users named.

Behind the scenes were many more enhancements. We have also greatly improved the site's speed, stability, and accuracy by adding server capacity, extensive testing capabilities, and more automated error checks and warnings. But still, along with all this new code in an extensive app as this one, it is inevitable for a bug to sometimes creep into production, and you can blame me entirely for those.

So I also want to give a special thanks to all of you who have graciously reported anomalies you saw or asked for clarification. This greatly helped me find the bug if there was one or to clarify the app and its documentation to eliminate confusion. Many of you are already in the list above since the power users that use the app extensively and push it to its limits, are also the most likely to both see anomalies and to make suggestions. Additional thanks to sympatheticRaisins4, impartialLollies5, astronomicalToucan8, stupendousSausage4, marvelousJerky8, incredibleBustard8, likableToucan0, decisiveGuppyhare3, courteousEggs8, fearlessRaisins5, enchantedTortoise1, focusedGranola0, lushEnzymeeukaryotefalcon1, adventurousBittern9, proficientLlama0, dependableTermite1, bustlingEnzymeeukaryotefalcon6, mountainousCheetah8. I thank you all for your patience and understanding.

Together, we are making the MoneyReady App the smartest financial planning app for you and all Canadians.

Onward to 2024! I wish everyone a happy and prosperous year.

Elisabeth Tillier, Ph.D.

President of MoneyReady

Today I'm happy to announce changes in the RATES/YIELDS/CURRENCIES section.

These mostly apply to advanced users who enter and follow their individual investments.

1. Setting default expected rates of return by asset classes.

If you've used this feature before you'll notice we have expanded the asset classes considered.

The rates entered will now be used to automatically set expected rates of return when investments are first entered, or first imported from Wealthica.

The defaults have been set to the FP Canada long-term recommendations but you can change those defaults and save them.

You can use them to change the default rates for all your investments at once at any time. You can now also opt-out any investment you never want changed by this feature.

2. Setting Long-Term future expected rates of return.

This allows you to set the TIME MACHINE to switch to long-term rates of return by asset class starting a given number of years in the future for all your investments.

This is an important new feature that permits simultaneous short-term and long-term financial planning.

It allows you to plan for shorter-term goals like buying a house, in conjunction with longer-term goals like retirement (or a later stage in retirement).

Many of my users are investors who follow their investments closely, including short-term investments with much higher or lower rates of return than the FP Canada™ projected long-term rates.

They want the rates to reflect their own expected returns for the short term, and see those reflected in the short-term projections.

However, by allowing long-term projected rates to start from a later date, we can also obtain a reasonable long-term financial plan.

3. The Withdrawal Optimizer now allows changes in future rates.

The motivation to implement varying rates in the Withdrawal Optimizer came about because of the new feature to automatically switch to long-term rates in the TIME MACHINE.

You can now optimize any TIME MACHINE run that uses that feature, anywhere you have set future rates manually in the Rates table,

and it even runs with market-crash scenarios and market simulations (although the usefulness of this on such simulations is doubtful).

Please see the expanded RATES/YIELDS/CURRENCIES section (7.1) of the eBook for details. Let me know if you have questions.

Happy holidays everyone!

You can now receive email notifications from the MoneyReady Forum.

This is turned off by default. To turn it on, first log in. On the Forum page, click on the arrow next to your username to go to Settings. There you can select from 3 options:

- Email me when there is a new Post in a Topic that I track

- Email me when there is a new Topic in the Announcements forum

- Email me when there is a new Topic in any Forum

Click Save once you've made your selection. You can select all 3 options but you will only get 1 email if more than one option applies for a new post.

I recommend you select option 2 to be immediately informed of any new features and changes on the MoneyReady App.

You can turn off the emails anytime by changings your Settings again.

Today Wealthica announced Free to Fee. That is no more free automatic updating of your accounts, you need to subscribe for a fee with them.

How does this affect your investments entered in the MoneyReady App?

We update whatever Wealthica gives us, so if you are subcribed with them that will continue.

We also update any investments you've previously entered with Wealthica with FundData automatically. This updates current values based on market data, given the number of shares that were entered. If you no longer have a Wealthica subcription, you just have to make sure to update your investment shares and cost basis any time you make a transaction on those investments.

If you've never had a Wealthica subscription (or never linked) and want your accounts updated automatically, for each of the investments you want to track, make sure to "Add investment" to the account its in, by the investment's currency, and in the "Symbol Search. Start typing name or symbol for Stock, ETF, Mutual F und or Segregated Fund" box enter that investment. For these entered investments, values are updated nightly with market data from FundData. You just have to make sure to update your investment shares and cost basis any time you make a transaction on those investments.

If you have a valid Wealthica subscription and linked to Wealthica, even transactions are automatically updated for you so you will see updated values, shares and book values automatically.

I'm happy to announce a new visualization for cash-flows you can find for every year in the TIME MACHINE by clicking on the year in the first column of the TIMETABLE.

These are called Sankey Diagrams and here is an example of what that can look like:

- We’ve added support for Family RESPs.

- We’ve added support for naming the same beneficiary to multiple RESPs (Individual or Family).

- We’ve added support for the Québec Education Savings Incentive (QESI).

- We’ve added support for RESPs from which funds have been previously withdrawn.

White-paper on permanent-life-insurance. From PLW (an investment advisor firm):

Life insurance is a financial contract that pays out when the life of the insured ends. This paper is designed to give an overview of life insurance as a concept, including an analysis of life insurance as an investment. We observe anecdotally and empirically that some types of life insurance are sold more as investments than as risk transfer contracts. We call this practice into question through analysis of after-tax returns for traditional investments and life insurance. We suggest that the motivations to sell insurance as an investment are, in many cases, related to conflicts of interest.

- A new graph. A graph of TFSA and RRSP room at the end of each year in the TIME MACHINE is now shown in the results. This is in addition to the graph of TFSA and RRSP room at the beggining of each year. These will help you determine how much room you have and how much room you used up each year.

- The TIME MACHINE's results large table shows net-deposits to accounts (total deposits minus withdrawals) in the year. The individual year reports now break down the deposits and withdrawals to accounts. Instead of just the net amount seen in the Cash IN or Cash OUT sub-tables, you might have an entry for the same account in both, ie. the total withdrawals for the year, and the total deposits for the year separately.

- The Excel download of all investments in all acccounts now has an additional column showing the owner of the account (useful if there is a spouse).

The first 2 changes will only apply to new TIME MACHINE runs as they can't be made retroactively.

These changes were made due to user suggestions, so thanks for your feedback!

We've added a new way to add repeating expenses, so we now offer three options for entering the dates and amount applicable for an expense.

When logged in, you can select to search all the MoneyReady documentation using OpenAI from our forum search page. Just type in any question you may have and a response will be generated with an OpenAI large language model. The model has been fed all the information in the MoneyReadyApp eBook, all the app's help pages, all the forum posts, all our blog posts, the app's homepage, and our various other pages. It is instructed to answer only based on those documents. It does not know your data.

The answer given is sometimes surprisingly smart, sometimes disappointingly wrong, and often incomplete. We attempt to provide the references to the top documents it used to form its answer so you can quickly find the source of the information.

If the AI answer is not useful, please don't hesitate to contact us with your question or post it on the Forum. You'll get a real human to respond.

To accomodate mostly pensions but also any other INCOMES, REVENUES, EXPENSES and AUTOMATIC SAVINGS/WITHDRAWALS that are indexed proportionaly to inflation, we' ve added a new parameter to fine tune indexing to inflation in the TIME MACHINE.

See the FAQ for (logged in) users: https://www.moneyreadyapp.ca/forum/topic/76-how-is-indexing-to-inflation-set for details.

You can now specifify the months to add to the age you start/started taking the pensions. The CPP/QPP Optimizer will still only explore the starting dates on each of your birthdays after retirement.

From the Projection Assumption Guidelines:

"Making projections is critical to creating financial plans that help clients realize their long-term goals," says Julie Seberras, CFP®, MBA, FCSI and Chair of the FP Canada Standard Council™ Standards Panel. "The Projection Assumption Guidelines are a useful tool for planners to ensure their projections are based upon sound assumptions."

The Guidelines are intended to be used when making long-term projections of 10 years or more, and they're meant to look beyond the current day rate environment. For shorter-term financial projections (less than 10 years), financial planners may use actual rates of return on fixed-term investments held to maturity and dividend yields on equities.

The Projection Assumption Guidelines for 2025 are as follows:

|

Inflation rate |

2.10 % |

|

Return rates |

|

|

Short-term |

2.40 % |

|

Fixed income |

3.40 % |

|

Canadian equities |

6.60 % |

|

U.S. equities |

6.60 % |

|

International developed market equities |

6.90 % |

|

Emerging market equities |

8.00% |

|

YMPE or MPE growth rate |

3.10 % |

|

Borrowing rate |

4.40 % |

Note that these are all before fees.

To help with your expense planning, we've improved the presentation of the EXPENSES table.

You can now add a Subtype as well as a Type descriptions on expense entries to allow for more refined breakdown of expenses.

To make entering those expenses easier, there’s now a dropdown so you’ll be able to select for the Type from any previously entered types, or create a new type by typing it in. Same goes for the Subtype.

Above the EXPENSES table you’ll see buttons to group by date range (beg to end), by Type or by Subtype. The groups will have a subtotal in CAD and today’s dollars added to the table. The Type and Subtype groupings are still first grouped by date range (otherwise a subtotal makes no sense).

Below the table are additional graphs for the Type and Subtype groupings over time. These can be toggled to full screen by clicking on them. The graphs are also available in the pdf Report (for new runs). The Excel download EXPENSES tab of the TIME MACHINE results should show each entry with its type and subtype.

Type and Subtype are completely optional, they are just separate tags, so not truly hierarchical, and if no types or subtypes are entered anywhere, these columns will not appear on the web, pdf, or Excel download.

We've tried to make this very generic to suit everyones needs to use as they like to set things up. Your comments and suggestions are welcome.

In most cases, if your province was set in your PROFILE to Québec, the default is you will be eligible for QPP. If set to another province, the default is you will be taking CPP. However there can be exceptions to that. For example if you lived and worked in another province, but choose to retire in Québec, then you will be eligible for CPP and not for QPP. For this reason, we allow you to select the other plan by checking the box in the input form. The province in your PROFILE will still determine where provincial taxes are payable.

We have implemented the changes for QPP that were announced in the March 21 2023 Québec budget to apply from Jan 1, 2024. Although these changes will require legislative and regulatory amendments and as of this writing on April 1 2023, we have not yet seen the details of their implementation. We'll be monitoring closely and will make changes as necessary.

Nous avons mis en œuvre les changements pour le RRQ qui ont été annoncés dans le budget du Québec du 21 mars 2023 et qui s'appliqueront à partir du 1er janvier 2024. Bien que ces changements nécessitent des modifications législatives et réglementaires et qu'à ce jour, le 1er avril 2023, nous n'ayons pas encore vu les détails de leur mise en œuvre, nous les surveillerons de près et apporterons les changements nécessaires.